In the last chapter of the guide series on how to make an eCommerce website from scratch, we covered 27 tricks to optimize eCommerce images. The current chapter is about choosing the best eCommerce payment solutions for your eCommerce.

The global digital payment market size is expected to increase at a CAGR of 20.5% by 2030. So choosing the right eCommerce payment solution should be your priority as an online business owner.

But choosing the right solution for your business can be a task when customers have hundreds of payment methods available at their fingertips.

You may need to consider factors like payment speed, security, credibility, ease of integration, etc. Also, failed payments have already made the global economy lose $118.5 billion because 60% of businesses lost customers, among other reasons. Payment failures affect your consumer retention poorly.

So before you sweat over choosing the right fit, we have compiled a list of the top 13 tried and tested eCommerce payment solutions.

Let’s check them out!

- eCommerce payment solution #1 PayPal

- eCommerce payment solution #2: Apple Pay

- eCommerce payment solution #3: Stripe

- eCommerce payment solution #4: Google Pay

- eCommerce payment solution #5: Masterpass

- eCommerce payment solution #6: Amazon Pay

- eCommerce payment solution #7: Square

- eCommerce payment solution #8: Authorize.net

- eCommerce payment solution #9: 2CheckOut

- eCommerce payment solution #10: Adyen

- eCommerce payment solution #11: Payline Data

- eCommerce payment solution #12: Shopify Payments

- eCommerce payment solution #13: Klarna

- How to choose an eCommerce payment solution for your online business?

- FAQs

eCommerce payment solution #1 PayPal

With over 400 million active users and 30 million merchants worldwide, PayPal is one of the most preferred payment platforms.

So if you have recently ventured into an eCommerce business, then PayPal can help you gain the trust of your customers as a brand because consumers are 54% more willing to buy if a business accepts PayPal. So rest assured about meeting your consumers where they are!

PayPal caters to your customer’s payment needs by allowing them to pay from anywhere in the world using their preferred payment methods.

Features

- provides multiple payment options for customers:

- online checkout on your website, via a mobile app, and via social media

- via email

- Pay Later in installments

- charge recurring subscription payments

- accepts 100+ currencies and offers local payment options in certain regions

- connects with all major marketplaces

- allows accepting payments from 200+ markets via PayPal, Venmo, Debit cards, Credit cards, PayPal Credit (available in certain countries), iDeal, Mercado Pago, etc.

- can generate invoices, estimates, reports, and personalized and shareable payment links

Benefits

- is easy to use and integrate, reliable, and secure

- saves the hassle of currency conversion

- allows sending payment requests to customers using their email address

- improves business visibility by placing you where your customers are present

- permits tracking all PayPal transactions from different marketplaces at a centralized location

Limitations

- has a high chargeback fee

- customer support is tough to get hold of

- high costs may apply to small transactions

- may freeze your account if you violate the terms and conditions

Pricing

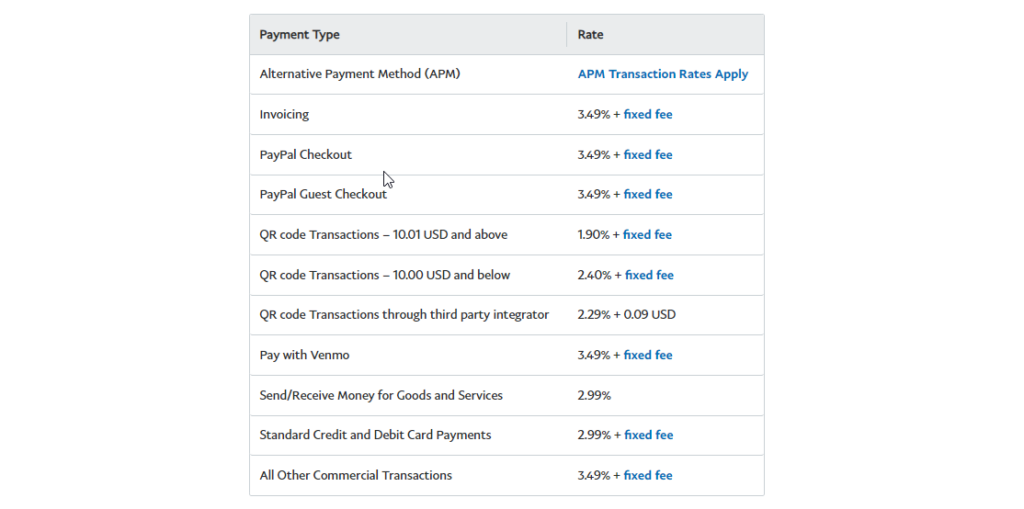

PayPal charges different payment fees from merchants depending on the market/region. These are PayPal’s standard rates for commercial transactions in the US.

For receiving international payments from customers, you’ll be charged 1.50%.

Best for

New retail online stores trying to build a consumer base and big corporations

Reviews

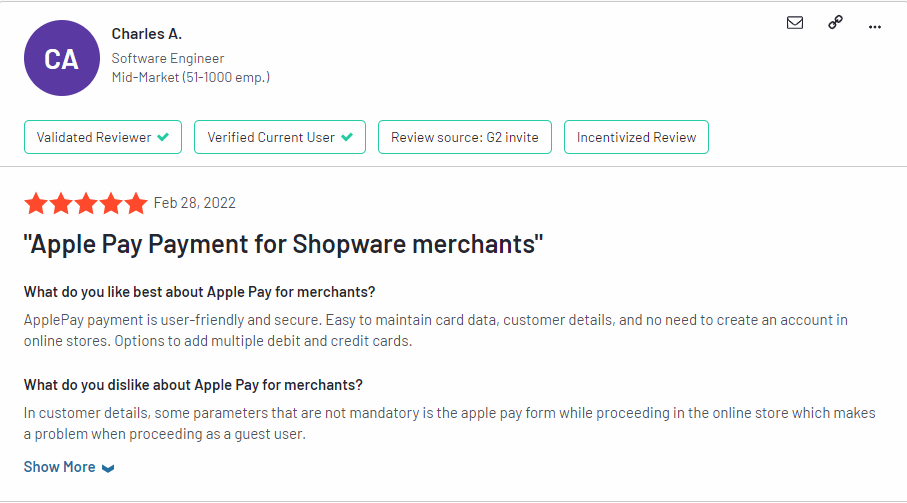

eCommerce payment solution #2: Apple Pay

Apple Pay is a fantastic tool for Apple users as it allows faster checkouts for purchases made on the Safari Browser on Mac or iOS devices.

It aims to replace physical cards and provide a private payment method that’s easier and more secure.

Apple users must tap the Apple Pay button and scan their fingerprints to initiate the transaction. It saves them the time to enter card and shipping details.

Features

- is easy to set up

- auto-detects apple users

- assures privacy and security to you and your customers (Apple never shares customer data with you!)

Benefits

- is free to integrate, faster, and easier than a card or cash payments

- provides super fast payment processing and checkouts

- allows customers to pay via an iMessage app and Messages for Business or on your website

- appeals to a young demographic with high mobile usage; business targeting school and college students can largely benefit

- removes friction for your customers at the time of checkout

- doesn’t need any extra hardware or terminal to accept payments

Limitations

- is only accessible to Apple Users

- requires an SSL-certified domain and a separate payment gateway

Pricing

You can collect payments via Apple Pay for free. But you’ll need to pay the transaction fees for your payment gateway.

Best for

Retail, fashion, manufacturing, and food beverage businesses looking to target only a niche audience of Apple device users.

Reviews

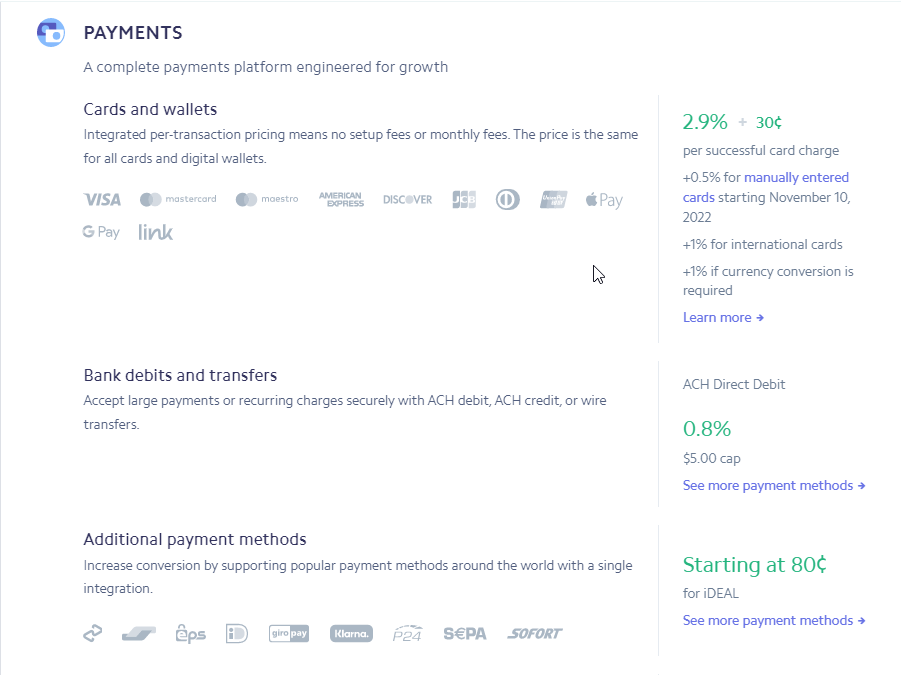

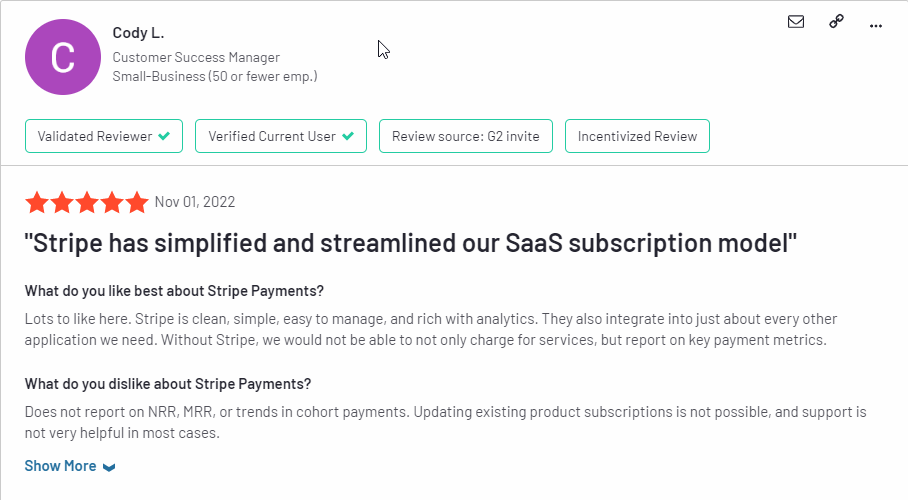

eCommerce payment solution #3: Stripe

Stripe is a powerful online payment solution on the rise. It offers its services to millions of small and large businesses all over the globe. Big names like Wayfair, Peloton, and Warby Parker trust Stripe as their payment solution.

Its highly customizable platform offers its software to accept payments, send payouts and manage a business online.

Stripe uses machine learning to detect any potential fraud and generate more conversions.

Features

- offers quick and easy integration with several payment options

- accepts payments in 135+ currencies

- offers early fraud detection by Stripe Radar

- provides dynamic 3D security for safe payments.

- offers 24/7 customer support via email, live chat, and phone.

Benefits

- offers a wide range of payment options

- provides a customizable checkout flow for consumers by adapting to their language and device

- supports global payment methods

Limitations

- is expensive for small businesses

- is more developer-centric, therefore, tough to understand

Pricing

Best for

Big eCommerce enterprises in retail and IT industries

Reviews

eCommerce payment solution #4: Google Pay

Google Pay (Gpay) is one of the best payment methods if you’d like a place for your customers to store their debit and credit cards. It simplifies the consumer checkout process by securely storing their information and enabling a simple tap of a button for payments.

Google Pay is a widely used payment platform trusted by people for security due to Google’s reputation, which uses tokenization for storing customers’ card details. Gpay doesn’t show these details to you, ensuring high-level security for your customers.

Features

- offers simple and seamless payment processing

- provides great incentives like rewards and cashback that motivate users to make payments

- gives insights into your sales figures

- allows you to create a custom business channel for your store in the app for free

- offers built-in templates for sending reminders, receipts, and tickets to your customers

Benefits

- has a simple and free integration process

- is a secure platform trusted by customers

- offers rewards and special offers just for using the app for business

- provides faster checkouts to your customers

- charges zero fees to you and your customers

Limitations

- isn’t available for businesses in France.

- needs you to integrate a payment gateway to get enabled in your store.

- the Google Pay button is only visible on a few browsers: Google Chrome, Mozilla Firefox, and UC Browser

Pricing

You can collect payments via Google Pay for free. But you’ll need to pay the transaction fees for your payment gateway.

Best for

Retail, fashion, and manufacturing businesses that demand world-class security for them and their customers

Reviews

eCommerce payment solution #5: Masterpass

Masterpass, renamed “Click to Pay,” aims at simplifying payments to just a click. It helps consumers save their credit and debit card details and checkout without typing in the payment details.

On top of it, their encryption technology ensures the collected payment details are tightly secured. Your customers can also save themselves the hassle of remembering passwords or saving payment details whenever they change their devices.

Features

- provides lightning-fast 3-step checkouts

- has great security features, such as advanced bot detection

Benefits

- is against fraud for consumers with a Zero Liability Protection policy

- offers several checkout options for merchants to invite and retain customers

Limitations

- has limited offerings as compared to other digital wallet systems

Pricing

There is no fee for merchants to use Masterpass.

Best for

Retail and manufacturing businesses that want to prioritize speedy checkouts

Reviews

eCommerce payment solution #6: Amazon Pay

Amazon Pay is “more than a button” for your customers. It’s “a brand they know and trust.”

Amazon offers this secure and reliable solution for your customers to use their credit and debit card details stored on their Amazon profiles to make online payments quickly and safely.

Since it doesn’t require customers to create an account during checkout and significantly decreases time, Amazon Pay helps you drive more conversions.

Features

- offers a dynamic checkout button for your product pages

- is available in 170+ countries

- has a multi-currency feature that supports 12 currencies

Benefits

- offers great technical and dedicated account support

- allows fast and easy integration

- features recurring payments to allow your customers ease of buying subscriptions, paying bills, and making future purchases

- reduces high-risk transactions and saves you from chargebacks

- allows 49% faster payment processing than normal checkouts

Limitations

- only supports a few currencies

- doesn’t support stores in many countries

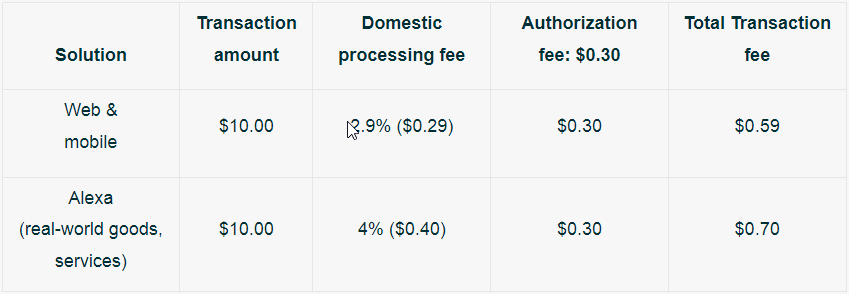

Pricing

For cross-border transactions: 1% extra fees

Best for

U.S.-based retail, fashion, or manufacturing businesses already using an Amazon seller account

Reviews

eCommerce payment solution #7: Square

Square promises to help “businesses grow both in-store and online.” It offers a wide range of payment options, such as Magstripe, chip cards, and contactless modes of payment to your customers.

Square also offers an extensive feature set for small businesses, including add-on solutions like appointment booking, payroll, and employee management. You can generate and send digital invoices to your customers or “sell via text.”

It also works seamlessly with several third-party eCommerce technologies.

Features

- is a great eCommerce website builder

- provides a free domain, and online store

- offers “buy now and pay later” using Afterpay

- has flexible omnichannel commerce tools

- offers add-on services for growing businesses

Benefits

- has no monthly fees

- offers competitive and same transaction fees for all major cards

- is free from long-term contracts

- allows selling by phone using Square Virtual Terminal

Limitations

- is not ideal for high-risk merchants.

- is only available in the US, U.K., Canada, Australia, and Japan as a payment gateway.

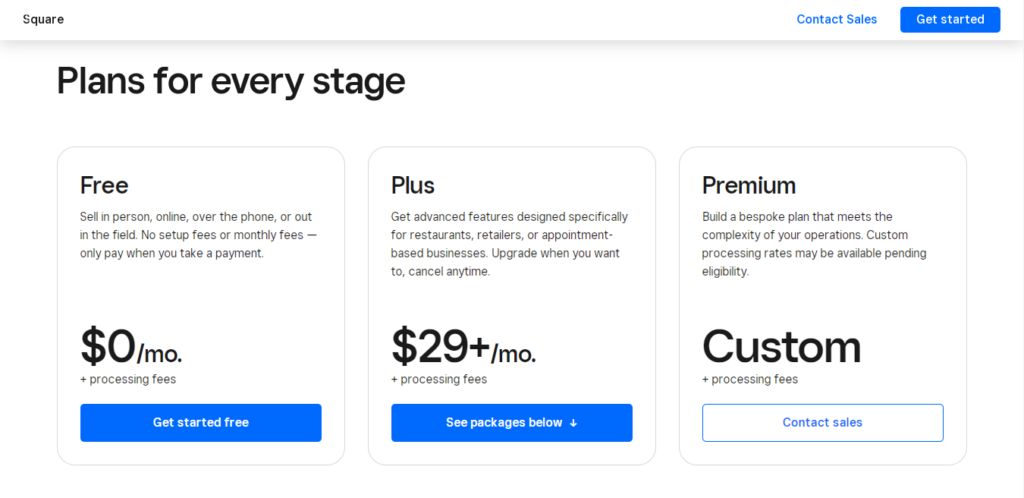

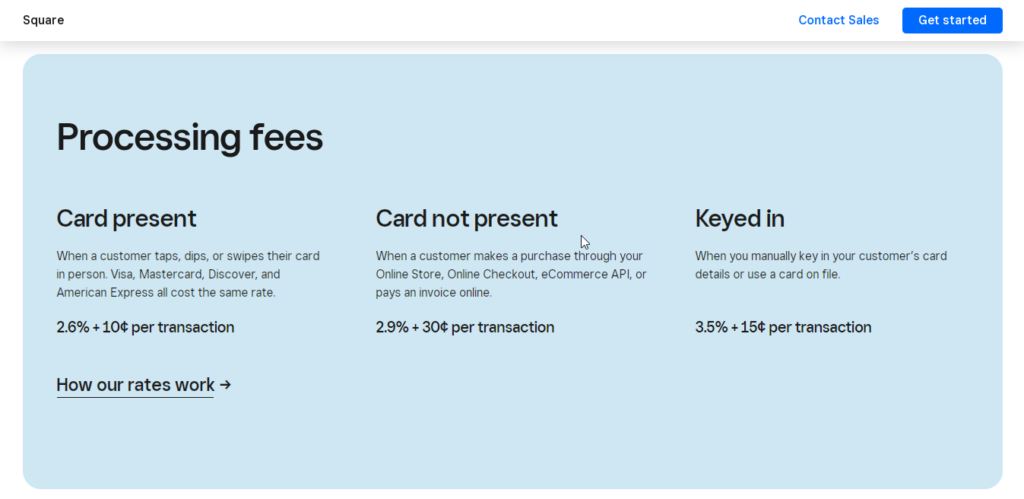

Pricing

Best for

Retail, beauty and wellness, food and beverage, and service businesses in need of a full-service point of sale with integrated payment processing

Reviews

eCommerce payment solution #8: Authorize.net

Authorize is another versatile payment gateway that allows you to offer several payment methods to your consumers. It aims to make payments possible anytime, anywhere.

You need a merchant account to operate with Authorize, which you can purchase from their providers or separately.

It allows you to receive customer payments using multiple options, including credit cards, debit cards, PayPal, and Google Wallet.

Features

- offers customization options, reliable customer support, and advanced fraud protection

- gives alerts on suspicious transactions

- features eChecks as another digital payment option

- poses no limit on the size of transactions

- allows transaction processing in multiple currencies

Benefits

- saves your eCommerce business from high-risk orders

- offers swift and automatic payment settlement to your bank account

- ensures high data encryption security for payment processing

Limitations

- needs a separate merchant account

- UI is not so user-friendly and attractive

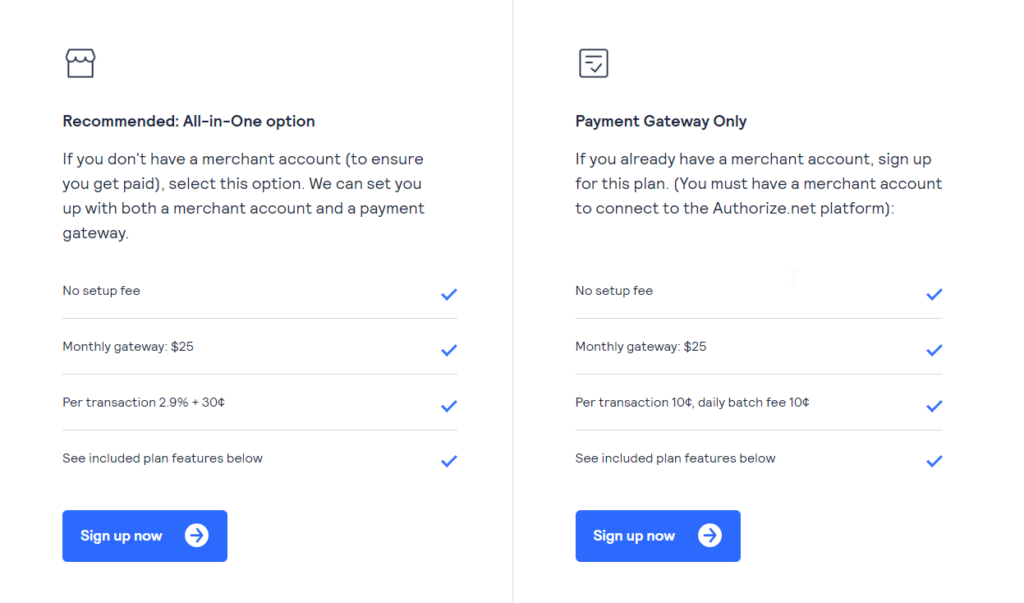

Pricing

Best for

Small businesses in retail, manufacturing, and computer software sectors looking for a direct payment gateway that focuses on security and customer support

Reviews

eCommerce payment solution #9: 2CheckOut

Global payment processing is at the center of 2CheckOut’s operations. 2CheckOut (now Verifone) lets you accept payments from more countries than PayPal. It is an “all-in-one monetization platform” that prioritizes your revenue and ease of making sales online.

Moreover, you can also look after subscription billing, taxes, or other eCommerce payment needs. It also allows customization options to add more features as your business grows.

Features

- charges no setup or monthly fees

- offers multiple customizable checkout options

- integrations include over 100 online carts, an API, and a sandbox

- offers 87 currencies, eight payment types, and 15 languages to choose from

- provides advanced fraud protection with over 300 security protocols for each transaction

Benefits

- provides recurring billing setup

- features mobile-friendly, branded, and localized checkout

- accepts all major payment methods, including credit cards, debit cards (Visa, MasterCard, Maestro), and PayPal transactions

Limitations

- every chargeback costs you $20

- charges extra 1% fee to customers from the US

- the average currency conversion fee is 2-5% more than the daily bank exchange rate

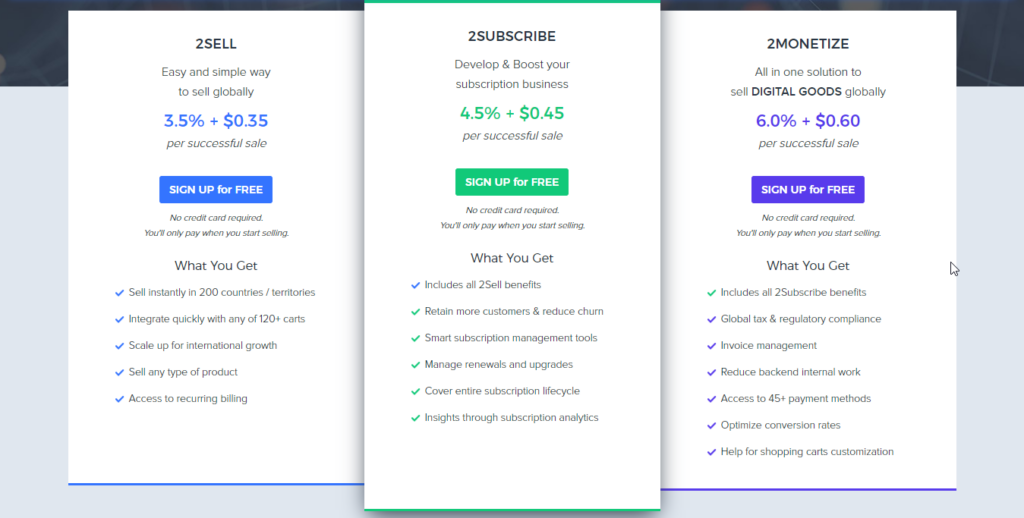

Pricing

Best for

Service-based businesses associated with computer software

Reviews

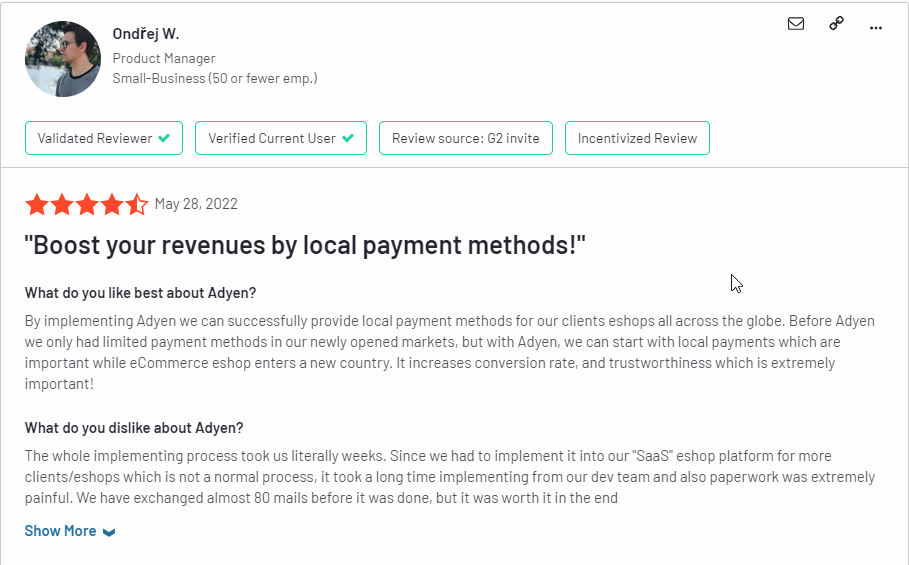

eCommerce payment solution #10: Adyen

Adyen is an “end-to-end solution for payments, data, and financial management.” With the ability to add new payment methods, scale to new markets, gather cross-channel insights in one place, and detect fraud, Adyen claims to be a one-stop platform for merchants.

Major technology companies, like Spotify and Etsy, trust Adyen for their online payment processing.

Features

- provides a payment gateway

- provides integration options for in-app or mobile payments

- has several optimization tools

- offers excellent security features

Benefits

- charges zero setup or monthly fee

- is a complete eCommerce payment processing solution

- offers data-driven insights using machine learning technology

- allows you to gather your in-store and online payment data in one place

- provides customer-friendly authentication

Limitations

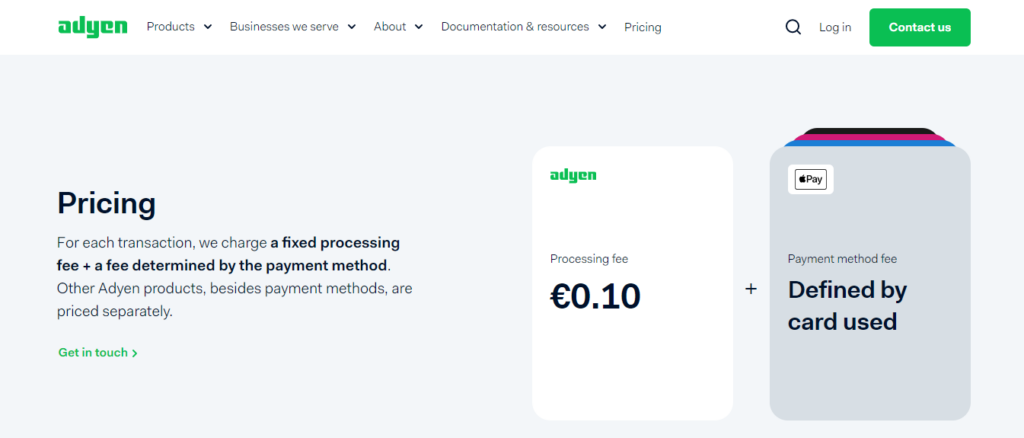

- has a complex pricing system

Pricing

Best for

Businesses that accept orders via multiple channels and require a merchant account

Reviews

eCommerce payment solution #11: Payline Data

Payline Data simplifies your payments with diverse mobile, online and in-store solutions.

You will also find extra features such as a credit card reader, a virtual terminal, and direct integration with QuickBooks.

These features allow accepting cards online with an internet-connected device.

Features

- is flexible

- has an in-built calculator to predict your monthly fees

- offers a wide range of in-store credit card processing packages

- Fully-featured API for integrations with third-party platforms

Benefits

- offers seamless reporting to track sales

- has a transparent pricing structure

- takes only one day to process your funds

Limitations

- is only available in the US so far

- has a complex pricing system

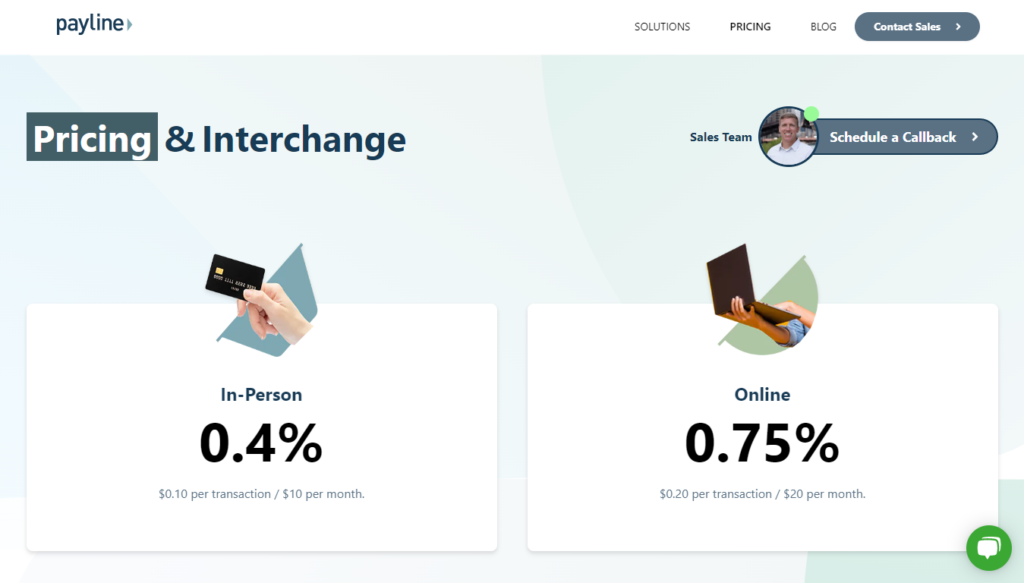

Pricing

Payline follows an interchange plus pricing system. Thus, the fee varies based on the type of cards you process in a payment cycle.

Best for

Businesses that deal with high-risk and high-volume transactions

Reviews

eCommerce payment solution #12: Shopify Payments

While Shopify focuses on helping business owners build effective eCommerce websites, it also offers a competent payment solution.

Shopify payments have almost all digital payment services. It is a secure online payment solution accessible to all Shopify merchants.

It allows consumers to pay via major credit card and payment providers like Visa, Mastercard, American Express, Apple Pay, Google Pay, and more.

Features

- offers 3D secure checkouts

- provides easy payment tracking

- supports automatic currency conversion

- has lower processing fees compared to other payment gateways

Benefits

- accepts payments in local currencies

- provides automatic fraud analysis on store orders

- allows saving up to 2% on transaction fees on third-party payment gateways

- provides shipping insurance of up to $200 if you use Shopify Shipping

- saves you from complex integrations

Limitations

- is unavailable for stores in certain countries

- it takes time to process payments

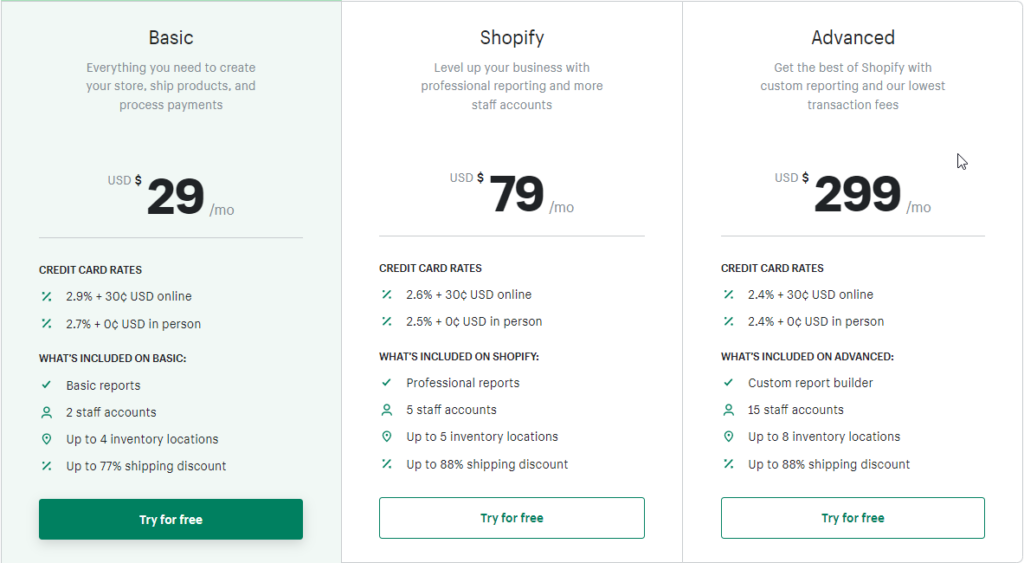

Pricing

Best for

Businesses using Shopify as an eCommerce platform and POS system

eCommerce payment solution #13: Klarna

Klarna is known for its AI technology that enables it to conduct “buy now, pay later” exchanges. It enables consumers to pay how they like.

Klarna also allows you to integrate your store with e-commerce platforms, apps, and social media sites.

It offers four payment options to your customers:

- 4 interest-free installments

- pay in 30 days

- pay in 24 months

- pay instantly

Features

- offers a conveniently easy checkout process

- pays the merchants upon checkout

- quick and simple integration

Benefits

- customers can purchase and use the products and pay after delivery

- pays you in full and upfront, even when the customer pays later

- brings your more business and revenue with flexible payment options

- offers frictionless checkouts to your customers (as fast as 25 seconds!)

Limitations

- has an inadequate customer support

- may take time to process customer refunds

- often declines purchases without concrete reasons

Pricing

A fixed transaction fee of $0.30 and a variable fee between 3.29% and 5.99% of the transaction amount.

Best for

Businesses looking to offer customer financing and installments as payment plans

Reviews

How to choose an eCommerce payment solution for your online business?

To choose a full-fledged eCommerce payment solution for your e-store, consider the following factors:

Factor #1: Number of Payment Options

Consumers love to have multiple payment options to choose from per their specific needs.

So pick a payment solution that offers several payment options like-

- Credit/Debit card

- Net banking

- UPI

- EMI

- E-Wallets

Factor #2: Charges

Each payment solution works on its pricing model. But the high cost for a business comes from charges levied on each transaction.

Apart from this, you also need to look at any monthly fee, sign-up fee, and setup costs that may be associated before making a decision.

Also, look out for any hidden charges.

Factor #3: Sign-up and Integration Process

Most of the payment solutions are compatible with some specific eCommerce platforms. Some of them might have complex integration processes as well.

Thus, it is better to research the integration and sign-up process to get your business running in no time.

Factor #4: Security

Financial data is sensitive and needs to be handled securely.

So, your payment solution must follow data security practices like encryption and tokenization.

Certifications like EMVCO 3D Secure and PCI-DSS also determine the reliability of a payment solution.

Factor #5: Tracking systems

As a merchant, you should track a considerable volume of transactional data. So, a robust tracking dashboard helps keep an eye on the overall transactions and the due settlements.

Moreover, the dashboard should be accessible from devices like laptops, mobile, tablets, etc.

Before finalizing a solution, make sure you’re evaluating options based on your target market. For example, if your audience is in India, explore the best online payment gateway in India. Similarly, research the top gateways in the USA, UK, or any other region where you operate.

It’s time to make a choice!

Now that you know about some of the best eCommerce payment processing solutions, you need to figure out what works best for your online business.

Consider where you are in your business journey. It helps you figure out what features you need under what budget.

With these parameters in mind, you can check for a payment solution that can quickly integrate with your store and suit your target audience. Once you have figured out your payment strategies, it will be time to calculate the shipping costs and find the right shipping strategies for your eCommerce. We have covered the same in-depth in the next chapter as well.

FAQs

We have answered some questions you may have while making a choice.

Which payment method is best for eCommerce?

The payment method best for eCommerce is the one that suits your industry. There are several eCommerce payment solutions available in the market today. But no one size fits all. So, you need to check your business’s requirements and determine which payment method suits it more.

If you are starting, look at a widely trusted solution like PayPal or Shopify. However, you can look at alternatives like Stripe for more customizable options if you are an established business.

What is a payment gateway vs payment processor?

A payment gateway bridges a bank account and a payment processor. Its primary job is to encrypt and transmit the payment details to the payment processor. It also communicates the failure or success of the transaction back to the initiator of the transaction.

On the other hand, payment processors relay information from the issuing bank to the acquiring bank.

Which payment gateway is the cheapest?

The cheapest payment gateway is Adyen. But it has the most complicated pricing system. So your best alternative for Adyen is Stripe, with a comparatively easier pricing system.

What’s the best payment system for small business?

The best payment system for small businesses is PayPal. It helps new businesses build trust within their target audiences.

But if budget is an issue, you can consider more pocket-friendly payment systems like Adyen or Stripe.

Which payment gateway is safest?

The safest payment gateways are Stripe and PayPal, with solid security.

How does e-commerce payment system work?

An eCommerce payment processor works by fulfilling the following basic steps of a transaction:

1. authorization,

2. funding, and

3. settlement

On the merchant’s request, an eCommerce payment system submits the transaction details for authorization to the issuing bank.

If approved, the issuing bank initiates the fund transfer to the merchant’s account per the transaction details.

What are some free eCommerce payment solutions?

Some free eCommerce payment solutions are Google Pay and Apple Pay. But you will need a payment gateway to integrate these solutions into your store, which is a chargeable service.

What are the three types of payment systems?

The three (and more) types of payment systems are:

1. Cash: Cash payment is the most fundamental payment mode, where you exchange paper money or coins for a product.

2. Cheques: Cheques work best for higher transaction amounts where you issue a document to your bank that details the payee and amount mentioned in words and digits. But they take time to process and settle.

3. Debit cards: Debit cards allow consumers to spend money in their bank accounts for online transactions or in-store purchases.

4. Credit cards: Credit Cards allow consumers to borrow money for purchases they can pay for later at once or in installments.

5. Mobile payments: Digital wallets and UPI payments are new digital payment methods that eliminate the need for cards as you deal directly with the bank account.

6. Electronic bank transfers: Electronic funds transfers allow you to make money transfers online without direct intervention from the banks.