8 Best Payment Gateways in the UK – Complete Analysis (2026)

In the UK, over 80.29% of consumers shop online. But more than 11% abandon their carts due to payment difficulties. With billions in potential sales losses annually, the choice of payment gateway can make a big difference.

Businesses selling online need a reliable payment gateway to accept payments securely and efficiently. However, with so many options available one can get confused easily. This guide explores the top reputable payment gateways in the UK, helping you choose the perfect fit for your business transactions.

What are the Best Payment Gateways in the UK?

- Stripe – Best for scalability and customization

- PayPal – Best for a wide user base and familiar checkout experience

- Worldpay – Best for businesses with high transaction volume

- Adyen – Best for global payment processing and multi-channel sales

- Revolut – Best for low fees and international payments

- Shopify Payments – Best for Shopify stores

- Square – Best for startups and omnichannel businesses

- Opayo (Sage Pay) – Best for established businesses in UK

1. Stripe

Stripe is a leading financial services and software company founded in 2010. It offers payment processing software and APIs for e-commerce and mobile apps, simplifying payment integration for web developers. It is known for its scalability and wide range of customization features.

Stripe holds a leading position in the market, with over 1.2 million live websites using Stripe to accept payments. It operates in 47 countries and serves a wide range of customers. Among its clients are Airbnb, Amazon, BMW, and Toyota.

Across the UK, Stripe processes over 300 new ventures daily and processes nearly a billion transactions annually, highlighting its popularity and trust within the business community. Over half of all UK cities and towns are experiencing faster growth in payment volume than London.

Features

Here’s a table summarizing the key features of Stripe relevant to businesses in the UK:

| Feature | Description |

| Payment Gateway Type | Hosted payment gateway with pre-built payment forms like Checkout and API-based integration for custom experiences. |

| Payment Methods | – Supports over 100 payment methods- Online payments: credit cards, debit cards, buy now pay later, ACH transfers, Apple Pay, Google Pay, Amazon Pay, Revolut Pay, Swish, Twint, Zip, and more.- In-person payments: Stripe Terminal for point-of-sale systems. |

| Settlement Period | – Initial payout takes 7-14 days- Standard payout speed in the UK is T+3 business days.- Daily payouts are possible with a custom schedule.- Instant payout within 30 minutes |

| Mobile App Integration | Stripe offers SDKs for iOS and Android to integrate payments into your mobile app. |

| Customer Support | 24×7 phone, email, and chat support available, along with access to support center resources. |

| eCommerce Platforms | Integrates with major eCommerce Platforms like Shopify, Wix, WooCommerce, and more. |

| Other Integrations | Offers integrations with over 150 apps including Salesforce, Netsuite, and Adobe. |

| Security | Adheres to PCI Service Provider Level 1 standards for top-notch security. |

| Dashboard | Unified user-friendly dashboard providing insights about transactions, balances, payouts, and billing. |

| Clients | Trusted by startups and enterprises like Amazon, DoorDash, Instacart, Shopify, and Slack. |

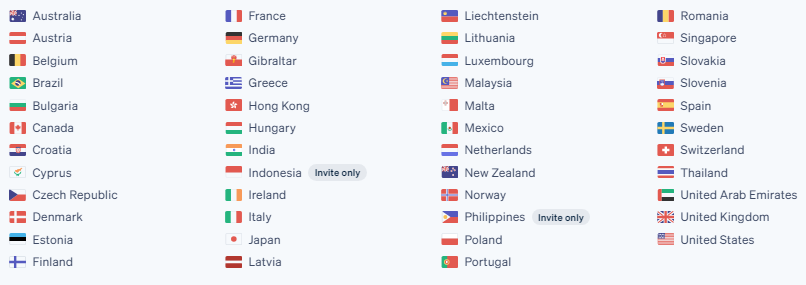

Stripe Pricing & Transaction Fees

Pricing Model: Pay-as-you-go.

- UK Cards: 1.5% + 20p per transaction.

- One Click Checkout Link: 1.2% + 20p per transaction for all UK cards

- Premium UK Cards: 1.9% + 20p per transaction.

- EU Cards: 2.5% + 20p per transaction.

- International Cards: 3.5% + 20p per transaction.

There are no hidden costs, setup fees, or monthly fees. Businesses with high transaction volumes or unique models can create custom packages.

You can find more details on Stripe’s pricing page here.

Pros

- Transparent, flat-rate pricing model with no setup, monthly, or cancellation fees.

- Advanced reporting tools.

- Subscription tools for recurring transactions.

- Seamless integration with popular website builders and eCommerce platforms.

- Accepts multiple payment methods

- Offers robust developer tools and APIs for customization and integration with bespoke systems.

- Prioritizes security with fraud prevention tools and PCI compliance.

- Allows global payments in various currencies.

Cons

- Higher fees for large transactions may be less advantageous for high-volume businesses.

- Instant deposits come with additional costs.

- Limited customer support options, primarily through email and documentation.

- Not suitable for high-risk industries, which may face stricter verification or service limitations.

2. PayPal

In the UK, PayPal is a dominant player in the online payment market, with over 20 million customers and 7 million businesses. Merchants can integrate PayPal seamlessly, thanks to its user-friendly interface. It offers options ranging from simple redirect pay buttons to API-based checkout systems.

It’s a good choice for businesses looking for a simple payment gateway. With PayPal for Business, you can accept payments, manage risk, and raise working capital for your company. In addition to debit/credit cards, PayPal’s wallet and credit services are supported across over 40 currencies and 240 markets.

There have been reports of account suspensions without clear justification, and resolving these issues may take some time. Even though PayPal is widely recognized and easy to use—particularly for those already holding PayPal accounts—it remains one of the top payment gateways in the UK.

Features

| Feature | Description |

| Payment Gateway Type | Hosted (Payflow Link) and Self-Hosted (Payflow Pro) options for varied checkout experiences. |

| Payment Methods | Wide range of payment methods for UK customers including PayPal, Pay Later, Pay in 4, PayPal Credit, Venmo, major credit cards, and various bank redirects like Bancontact, BLIK, eps, giropay, Google Pay, iDEAL, MyBank, Przelewy24, Sofort (Legacy), and Trustly. |

| Mobile App Integration | Robust JavaScript SDK and REST APIs for seamless mobile app integration. |

| Customer Support | Comprehensive support through PayPal Assistant, messaging, Resolution Centre, and agent assistance. |

| eCommerce Platforms Supported | Integration with major eCommerce platforms for easy payment acceptance. |

| Other Integrations | Supports third-party integrations for streamlined operations. |

| Security | -Biometric authentication, 2-Step Verification, and advanced fraud detection for secure transactions.-Compliance with regulatory standards like FCA in the UK. |

| Dashboard | User-friendly “Money Hub” dashboard for efficient daily tasks and transaction management. |

| Major Clients | Trusted by a diverse range of businesses including Argos, Spotify, Shein, Nike, Sonos, Microsoft, etc. |

PayPal Pricing & Transaction Fees

PayPal’s pricing and transaction fees in the UK are as follows:

1. Domestic Transactions:

- For card-funded payments from a user without a PayPal account, the fee is 1.2% + a fixed fee.

- For QR Code transactions above GBP 10.01, the fee is 1.5% + a fixed fee.

- For QR Code transactions GBP 10.00 and below, the fee is 2% + a fixed fee.

- For all other commercial transactions, the fee is 2.9% + a fixed fee.

2. International Transactions:

- The fee for receiving domestic commercial and QR Code transactions applies, plus an additional percentage-based fee for international commercial transactions.

- Where the sender’s market/region is within the EEA, the additional fee is 1.29%.

- For all other markets, the additional fee is 1.99%.

Please note that these rates apply to PayPal accounts of residents of the United Kingdom, Guernsey, Jersey, and the Isle of Man.

You can visit their official page for more detailed information about changes to PayPal’s rates and fees.

Pros

- Widely Used globally

- Flexible transfer options for sending, receiving, or requesting money securely.

- No fees for personal transfers.

- Free for many domestic transactions.

- PayPal Pay In 4 allows splitting purchases.

- Accepts various forms of payment, including cryptocurrency.

- Recognizable brand name instills customer trust.

- Offers multiple e-commerce features.

Cons

- High international costs.

- Bank transfers to PayPal can take several days.

- PayPal imposes a $20 chargeback fee.

- Lacks advanced point-of-sale (POS) features compared to some competitors.

- PayPal can freeze accounts, potentially delaying access to your funds.

3. Worldpay

Worldpay is a big name in the UK, handling over 40% of card transactions. It works across 146 countries and deals with 135 currencies. Over a million businesses use Worldpay globally, and they handle 2.2 trillion transactions a year. They offer online payment services, merchant accounts, and a Pay By Link service for businesses without websites.

Worldpay offers different payment plans, including pay-as-you-go and monthly subscriptions. They’ve become more flexible with contracts and fees. They also support over 300 payment methods. Since joining FIS Global in 2019, Worldpay has grown even more. It’s the top choice for over 250,000 small and medium UK businesses.

Features

| Feature | Description |

| Payment Gateway Type | Offers API-based integration for customized experiences and Hosted Payment Pages |

| Payment Methods | Accepts major credit and debit cards, digital wallets, and alternative payment methods for global reach and customer convenience. |

| Settlement Period / Payout Speed | – Next day settlement – 30 minutes fund transfers available |

| Mobile App Integration | Provides SDKs and APIs for mobile app integration, offering a native and highly customizable experience for mobile users. |

| Customer Support | 24/7 customer support for UK merchants, ensuring assistance is always available. |

| eCommerce Platforms Supported | Integrates with popular eCommerce platforms like Shopify, Magento, and WooCommerce, catering to online retailers’ needs. |

| Other Integrations | Supports third-party tools like Salesforce, QuickBooks, Xero, with features like network token support and SCA Exemption support, enhancing payment experience and business operations. |

| Security | Follows 3DS flex for authenticating card payments, Point-to-Point Encryption (P2PE) and PCI compliance to protect sensitive data and transactions. |

| Dashboard | User-friendly and customizable dashboard simplifies transaction management and reporting for merchants. |

| Major Clients in UK | Services leading UK-based companies like Tesco, Virgin Atlantic, and Zalando, showcasing reliability and scale. |

Worldpay Pricing & Transaction Fees

Worldpay offers a variety of pricing plans for businesses in the UK, with transaction fees starting at 1.5%. There are no hidden fees, and next day business settlement is available. Here are some of the specific plans:

- Simplicity – POS: This plan has a transaction fee of 1.50% for Mastercard and Visa card transactions, and there is a £17.50 card payment terminal fee.

- Simplicity – Gateway: This plan also has a transaction fee of 1.50% for Mastercard and Visa card transactions, but there is a £19.95 online gateway fee.

This pricing is available to customers with an annual card turnover of less than £300k. For businesses with an annual card turnover exceeding £300k, WorldPay offers custom pricing.

For more details visit their official page here.

Pros

- Comprehensive customer support ensures help is always available.

- Speedy fund transfers, with funds available in as little as 30 minutes.

- Extensive integrations with over 100 third-party business software.

- Large international processor, making it reliable for businesses of all sizes.

- Interchange-plus pricing available for flexibility.

- Single merchant ID for all transaction payments.

Cons

- Expensive card machines compared to others.

- Early termination fee of up to $295.

- Requires a three-year contract, which may not suit all businesses.

- Some users report misleading “free” terminal offers.

- High fees associated with Worldpay.

- Limited support according to some users.

4. Adyen

Ayden is a one-stop-shop for accepting payments, managing revenue, and controlling finances. It offers solutions for digital businesses, omnichannel businesses, and platforms & marketplaces, which has led it to be widely adopted by a wide range of merchants.

Ayden’s global reach with transactions in over 180 currencies makes it a popular choice for businesses with international customers. It allows businesses to accept both e-commerce and mobile payments alongside point-of-sale payments.

The platform’s integration capabilities are vast, providing ready-made drop-in solutions, pre-built components, and APIs for full customization. Additionally, Adyen has established partnerships with over 34 platforms, including Magento and Salesforce, ensuring seamless integration for merchants using these services.

Features

| Feature | Description |

| Payment Gateway Type | API-hosted gateway |

| Payment Methods | 100+ payment methods including Apple pay, WeChat Pay, Mastercard, Paypal, iDeal, American express, Google Pay, and many more. |

| Settlement Period / Payout Speed | Offers “Sales Day Payout” with payout scheduled for the agreed Business Day after the Transaction Day. |

| Mobile App Integration | Integration into mobile apps using SDKs and APIs for an enhanced customer experience. |

| Customer Support | 24/7 customer support via phone with trained specialists, along with an online knowledgebase. |

| eCommerce Platforms Supported | Supports major eCommerce platforms like Magento, Shopify, and WooCommerce for easy integration. |

| Other Integrations | Works with a wide range of partners and integrates with software solutions like Stripe Payments, BlueSnap, Square Payments, Payoneer, and Worldpay from FIS. |

| Security | Advanced fraud prevention measures and PCI DSS v3.2 compliance ensure secure payment processing. |

| Dashboard | Developer Dashboard for transparent integration monitoring and real-time insights. |

| Major Clients in UK | Counts global giants like Spotify, Uber, and Etsy, Microsoft, SKIDATA among its clients. |

Ayden Pricing & Transaction Fees

Adyen operates on a pay-per-transaction model. For each transaction, Adyen charges a fixed processing fee plus a fee determined by the payment method. There are no setup or monthly fees.

Here are some examples of the transaction fees for various payment methods:

- ACH Direct Debit: €0.11 + $0.27

- Alipay: €0.11 + 3%

- American Express (AMEX): €0.11 + Defined by card used

- BACS Direct Debit: €0.11 + £0.55

- Apple Pay: €0.11 + Defined by card used

Check the official Adyen pricing for more information.

Pros

- Advanced fraud detection to protect against unauthorized transactions.

- Supports over 250 payment methods.

- Fast payout settlement.

- Access to 180+ currencies and diverse payment methods for global transactions.

- Offers a unified platform for consistent customer experience.

- Supports payments across e-commerce, mobile apps, and stores.

- Provides valuable analytics and reporting tools.

Cons

- Complex setup.

- Higher cost structure.

- Delayed or insufficient customer support

5. Revolut

Revolut, a popular neobank with a London base, offers a payment gateway designed to make taking payments a breeze for UK businesses. Regulated within the EU and UK, they prioritize secure transactions. Their strength lies in flexibility – customers can pay with cards, digital wallets, even contactless phone payments, all on top of traditional options.

Managing finances ith Revolut is a breeze too, with over 30 currencies accepted and segregated accounts for clear tracking. Integration is simple, with plugins for major ecommerce platforms and an API for custom websites. If you already use Revolut for banking, their all-in-one approach might be a perfect fit.

Features

| Feature | Details |

| Payment Gateway Type | – API hosted, – Payment links |

| Payment Methods | Accepts cards, Apple Pay, Google Pay, instant bank transfers, international, and commercial cards. |

| Settlement Period/Payout Speed | Fast settlement with funds typically available within 24 hours. Card reader transactions payout in under 3 seconds. |

| Mobile App Integration | Provides customizable widget and Merchant API for mobile app integration. Secure payment page for Payment Links compatible with mobile devices. |

| Customer Support | Dedicated 24/7 support team with in-app chat for immediate assistance. |

| eCommerce Platforms Supported | Integrates with major eCommerce platforms like WooCommerce, PrestaShop, Magento 2, OpenCart, and Shopify. |

| Other Integrations | Offers APIs, API Payouts, and documentation for connecting various business tools and services. |

| Security | Registered with the Financial Conduct Authority, providing advanced fraud protection and PCI DSS compliant. |

| Dashboard | Provides a user-friendly interface to create and share payment links, ensuring a straightforward experience. |

| Major Clients in UK | Includes notable clients such as Aer Lingus, Paloma Wool, FlyGo, and Archie’s Toastie Shop Limited, showcasing versatility across industries. |

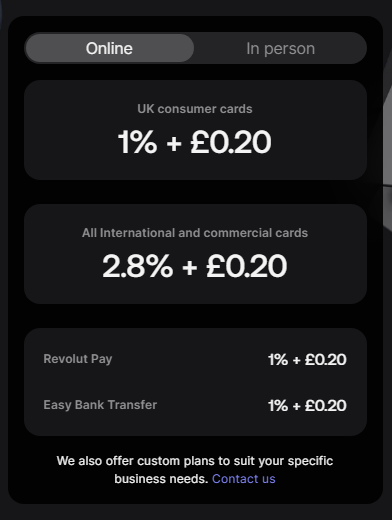

Revolut Pricing & Transaction Fees

Revolut offers a competitive pricing structure for businesses of all sizes. The pricing is clear, transparent, and designed to help businesses keep more of what they earn.

Card Acceptance Pricing

Revolut’s card acceptance pricing for online transaction is as follows:

- UK Visa and Mastercard consumer cards: 1% + £0.20 per transaction

- UK American Express consumer cards: 1.7% + £0.20 per transaction

- All International and commercial cards: 2.8% + £0.20 per transaction

- Revolut Pay and Easy Bank Transfer: 1% + £0.20 per transaction

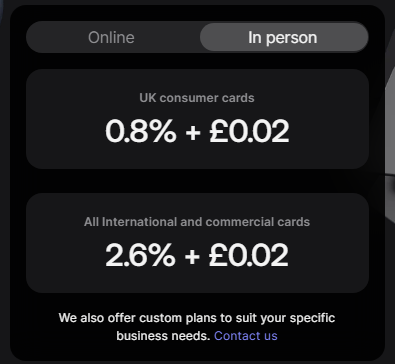

Revolut’s card acceptance pricing for in-person transaction is as follows:

- UK consumer cards: 0.8% + £0.02 per transaction

- All international and commercial cards: 2.6% + £0.02 per transaction

Custom Plans

For businesses with specific needs, Revolut offers custom plans. Businesses processing high monthly volumes can contact Revolut to discuss custom rates.

Revolut pricing model is simple and predictable, with a flat fee per transaction. Visit their official pricing page for more details.

Pros

- Global Accessibility

- Multi-Currency Support

- Revolut offers a fee-free standard account.

- Money transfers are free from Monday to Friday with certain limits.

- Revolut pays interest on savings in personal accounts.

- Fast Access to Funds

- The app includes budgeting tools and spending analytics.

Cons

- Revolut’s exchange rates may be less competitive.

- Larger transactions can incur higher fees.

- Revolut does not offer full banking services like overdrafts.

- Customer deposits are not protected by the Financial Services Compensation Scheme.

6. Shopify Payments

Shopify Payments, a part of the Shopify eCommerce platform, is a popular choice for businesses in the UK and around the world. It’s a seamless, secure, and fast way to accept payments from customers on your Shopify or Shopify Plus-based online store. It’s built on Stripe technology, but it’s fully integrated into the Shopify dashboard, making it more merchant-friendly.

Shopify Payments supports a wide array of payment methods, including debit and credit cards, Bancontact, and iDEAL. The platform also allows businesses to accept payments in different currencies, which can be a significant advantage for businesses with a global customer base.

The platform is flexible and intuitive. Shopify boasts a library of over 8000+ apps that you can link into your site. You can also choose from Shopify’s expansive library of site themes or build a custom page and checkout with the Shopify API.

As of now, Shopify Payments is used by 1.8 million merchants, representing up to 90% of all Shopify users. It offers everything you need to get started running an online business, from web hosting to payment processing to seamless integration with other sales channels such as Amazon and their own POS.

Features

| Features | Details |

| Payment Gateway Type | Self-hosted payment gateway |

| Payment Methods | Supports Shopify Balance, credit/debit cards, and ACH bank transfers. |

| Funds Settlements | Standard next business day. |

| Mobile App Integration | Uses Shopify’s API. |

| Customer Support | 24/7 customer support, Livechat, Chatbot, Shopify community and help center. |

| eCommerce Platforms | Supports a wide range of eCommerce platforms including Shopware, Adobe Commerce (Magento), WooCommerce, WordPress, and more. |

| Other Integrations | Integrates with over 100 third-party payment providers and various business tools/systems via APIs and SDKs. |

| Security | PCI compliant and uses 3D Secure authentication for added security. |

| Dashboard | Provides a comprehensive Online Store Dashboard with ready-made dashboards, reports, and customization options. |

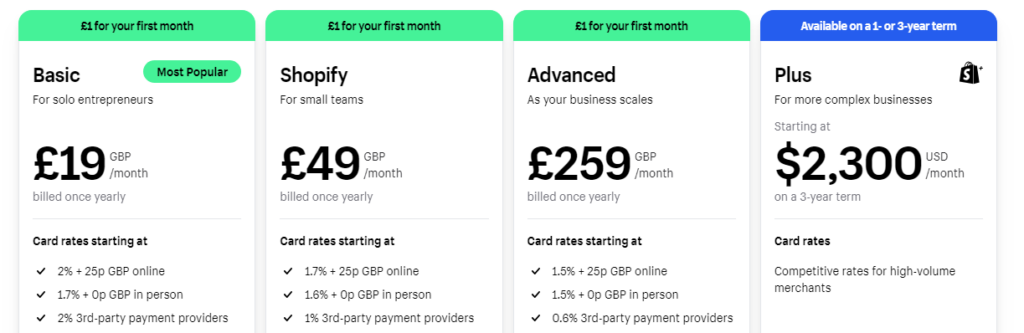

Shopify Payments Pricing & Transaction Fees

Shopify offers two options for payment processing: Shopify Payments and third-party payment providers.

Shopify Payments incurs a transaction fee depending on your plan:

- Basic Shopify plan: 2% + 25p per transaction

- Shopify for Small Teams: 1.7% + 25p per transaction

- Advanced Shopify plan: 1.5% + 25p per transaction

Third-party payment providers also have their own transaction fees. For complete pricing details visit shopify pricing plans.

Pros

- Automatically set up with Shopify stores.

- Easily track orders and payments through the Shopify platform.

- Built-in fraud analysis tools.

- Sell in different currencies with Shopify Payments.

- Transaction fees can be competitive depending on the plan.

Cons

- Shopify charges a fee with third-party payment gateways.

- The Advanced plan has a high monthly fee

- Retail Business POS costs an additional.

- Shopify Payments is only available in selected countries.

7. Square

Square, a tech company known for its unique card reader, is a prominent player in the UK’s payment gateway market. It now processes online payments, making it a comprehensive solution for small UK businesses.

Its platform supports multiple payment methods, including VISA, Mastercard, AMEX, Google Pay, and Apple Pay. Square’s setup process is simple, even for businesses without a tech-savvy team. You can either use their pre-built Square Checkout API or opt for the Square Web Payments SDK for a more personalized setup.

Square integrates easily with mobile devices and POS systems, offering flexibility in accepting payments. The online store builder tool also ensures smooth integration with their payment processing. Plus, it provides fast transaction processing time and supports EMV chip cards and NFC payments.

Features

| Feature | Details |

| Payment Gateway Type | API hosted |

| Payment Methods | Contactless payments, Mobile payments, Chip and PIN payments, Digital invoices, Checkout links, Buy now, pay later options through Clearpay and various card types with Visa, MasterCard, American Express, Maestro, Visa Electron, or Vpay logo. |

| Mobile App Integration | APIs and SDKs for developers to integrate payment services into their mobile apps. |

| Customer Support | 24/7 support via phone, email, and live chat |

| eCommerce Platforms | Integrates with Shopify, Wix, WooCommerce, Squarespace, and more |

| Other Integrations | Integrates with various third-party applications, including accounting software, point-of-sale systems, and marketing tools |

| Security | PCI-DSS compliant with industry-standard security measures |

| Dashboard | User-friendly online dashboard for sales tracking, inventory management, and customer data viewing. |

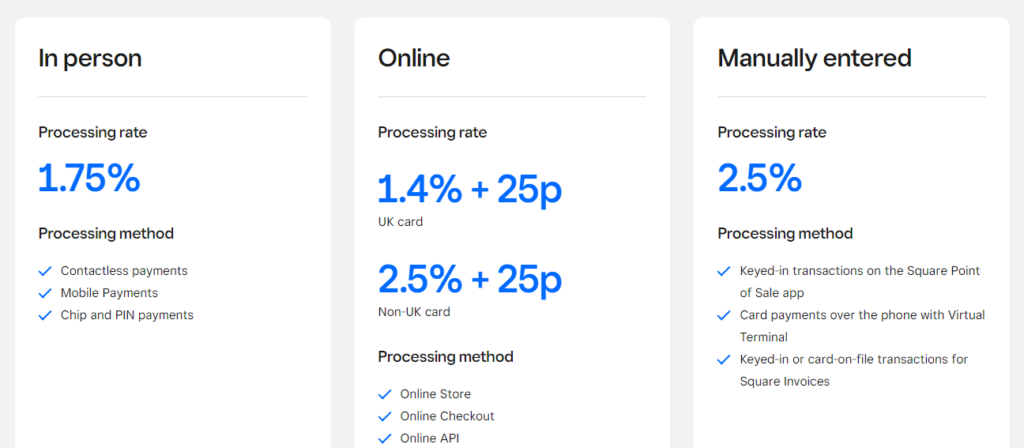

Square Payments Pricing & Transaction Fees

Square offers a simple and transparent pricing structure in the UK, with no hidden fees or long-term contracts. Here’s a breakdown of their transaction fees:

- In-person contactless payments, mobile payments, and chip and PIN payments: 1.75% per transaction

- Online transactions with UK cards: 1.4% + 25 pence per transaction

- Online transactions with non-UK cards: 2.5% + 25 pence per transaction

- Manually entered transactions: 2.5% per transaction

Visit Square’s pricing page for more details.

Pros

- No monthly fees

- Transparent flat transaction fees

- Accepts major cards and mobile payments

- Free POS software with compatible hardware

- Fast fund transfers

- PCI DSS compliant for secure transactions

- Offers additional services like payroll

Cons

- Less cost-effective for high transaction volumes

- Lacks advanced features for specialized needs

- No phone support

- Limited options for international payments

8. Opayo by Elavon (Sage Pay)

Opayo, formerly Sage Pay, is a big name in UK payments, trusted by over 50,000 businesses. They let you take payments online, in-store with card terminals, or even over the phone and by mail. They work with major ecommerce platforms like Shopify, Magento and WooCommerce, making setup a breeze. Plus, you can customize your checkout experience to match your website.

Opayo is a cost-effective option, especially for smaller businesses. They have a flat-rate monthly fee and even offer free transactions for your first 350 sales each month.

On top of all that, Opayo accepts all major credit cards, PayPal, and over 100 currencies. They also offer features like “pay by link” for easy invoicing and a cloud-based portal to see your sales data. Plus, their UK-based customer support is available 24/7.

Opayo has experience working with businesses in airlines, hospitality, transportation, and retail, so if your business falls into one of those categories, they’re definitely worth considering.

Features

| Feature | Description |

| Payment Gateway Type | self-hosted, API-hosted, and payment links. |

| Mobile App Integration | Opayo provides robust SDKs and APIs, enabling seamless integration with mobile apps. |

| Customer Support | Opayo offers free 24/7 customer support through online, phone, web, or Twitter. |

| eCommerce Platforms | Integrates with a wide range of eCommerce platforms including Salesforce, Magento, WooCommerce, Shopify, and Magento etc . |

| Other Integrations | Allows API and SDKs integrations.. |

| Security | Opayo is Level 1 PCI DSS compliant and offers free advanced fraud screening tools. |

| Dashboard | Opayo provides a user-friendly dashboard for managing payments. |

Opayo Pricing & Transaction Fees

Face-to-Face Payments

- Start Simple: £0 monthly fee, 1.75% transaction fee, £19 one-off device cost.

- Business Booster – Desktop: £15 monthly fee, 0.99% transaction fee.

- Business Booster – Wireless: £18 monthly fee, 0.99% transaction fee.

- Operate Smarter: £40 monthly fee, 1% transaction fee.

- Business Control: £62 monthly fee, 1.2% transaction fee.

Online Payments

- Always Open – Fixed: £25 monthly gateway fee, 0.99% transaction fee.

- Always Open – Pay As You Go: £0 monthly gateway fee, 1.99% per transaction, £0.12 gateway click-fee, £99 one-off joining fee.

Visit Opayo for more pricing details.

Pros

- Strong security

- Seamless Sage integration

- Detailed reports about chargebacks

- No transaction fee for first 350 sales

- Online portal to view and manage real-time business reports

Cons

- Confusing terms

- Potentially higher fees

- Lack of transparency in pricing

- Delays payments

Payment Gateway Integration Options

You have several options to choose from to integrate a payment gateway into your online store:

1. Payment Links

Payment links are the simplest integration method, allowing you to create a unique URL that directs customers to a secure payment page hosted by the gateway provider. This option requires minimal technical setup and is ideal for businesses with limited development resources.

2. Self-Hosted Gateways

With self-hosted gateways, the payment process takes place entirely on your website. This option provides greater control over the user experience but requires more technical expertise to implement and maintain.

3. API Hosted Gateways

API-hosted gateways offer a balance between ease of integration and customization. The payment process is hosted by the gateway provider, but you can use APIs to customize the checkout experience to match your website’s look and feel.

Making the Decision: Steps to Select the Right Payment Gateway

To select the right payment gateway, follow these steps:

- Think about your business needs. Look at who your customers are, how much you sell, and what you sell.

- Look at security features. Choose payment gateways that have strong security like encryption, tokenization, and tools to detect fraud.

- Compare costs. Look at transaction fees, monthly costs, and any hidden charges. Find the payment gateway that is the most affordable for your business.

- Check if the payment gateway works with your e-commerce platform and other tools. Make sure the payment gateway you choose can work smoothly with your current systems.

- Think about customer support. When you choose a provider, consider how good their customer support is. This will be important if you have any problems.

- Read what other businesses say about the payment gateway. Look at reviews and testimonials to learn about the payment gateway’s reliability, how easy it is to use, and if other businesses are happy with it.

FAQs

What is a payment gateway?

A payment gateway is a service that allows businesses to accept payments from customers through various payment methods, such as credit and debit cards, online wallets, or bank transfers. It acts like a secure bridge between the customer’s payment information and the business’s bank account.

How do payment gateways work?

When a customer makes a purchase, the gateway encrypts their payment information and sends it to the payment processor or acquiring bank. The processor verifies the transaction with the card association and the issuing bank, which either approves or declines the payment. If approved, the funds are transferred to the merchant’s account.

Which payment gateway has the lowest fee?

For businesses looking for a payment gateway with no monthly fees, Stripe, Square, and PayPal are viable options. The fee structure of payment gateways varies widely, and the one with the lowest fee will depend on the specific needs of a business, such as transaction volume and the types of transactions processed.

What is the largest payment processor in the UK?

Worldpay stands as the largest payment gateway in the UK, with PayPal and Stripe also holding significant market shares.

Which is the safest payment gateway?

The safest payment gateway is one that meets the highest security standards, such as PCI DSS compliance, and has features like encryption, fraud detection, and secure data handling. Businesses need to make sure that their chosen gateway encrypted cardholder data and has great security features.

How much does a payment gateway cost?

The cost of a payment gateway varies, but here are some specifics:

- Transaction Fees: On average, you can expect to pay between 1.5% and 3.5% per transaction, with some gateways charging a flat per-transaction fee, such as $0.30.

- Monthly Fees: Some gateways charge monthly fees, which can range from $0 for services like Stripe and Square, to $79 or $99 for plans that accommodate higher volumes of annual payments.

- Additional Costs: There may be other costs such as setup fees, chargeback fees, or fees for international transactions. For example, Stripe charges an additional 1% for international cards.

Which is the best payment gateway for small businesses in the UK?

Worldpay is considered the best payment gateway for small businesses in the UK. It offers top-notch support and strong security tools, making it a great choice for small firms without an in-house tech team.

Other options for small businesses include PayPal Stripe, Amazon Pay, Shopify Payments, and Opayo.

How do I know if my payment platform is safe?

The best way to find out if a payment platform is safe is if it meets level-1 PCI DSS compliance, uses encryption, and has fraud detection and prevention. Also, check for platforms with good security and good reviews.

Post a Comment

Got a question? Have a feedback? Please feel free to leave your ideas, opinions, and questions in the comments section of our post! ❤️