Would you like to learn how to set up tax rules in Magento 2?

What if I said that every Magento site does the same?

Better yet, what if I showed you step by step how to set up this rules based on the requirements of each location?

So let’s head forward, today I will be showing you many different sections of taxes and its application for which the list is as follows:

- Set up tax classes for specific products and customer group

- Create tax rules that combines the product and customer classes, tax zones.

- Set up fixed product taxes, compound taxes.

By following these steps, you will confidently set up tax rules in Magento 2 for your products, customers, and locations, ensuring accurate tax calculation across your store.

How to Create Magento 2 Tax Calculation

Create a Magento 2 tax calculation in 6 steps.

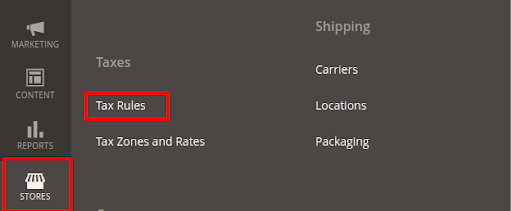

- Go to Stores > Taxes > Tax Rules

- Set the Tax Rule Information.

- Name the tax rule

- Select the Tax Rate from the available rate list or Manually add New Tax Rate

- Complete the additional Settings.

General Tax Settings

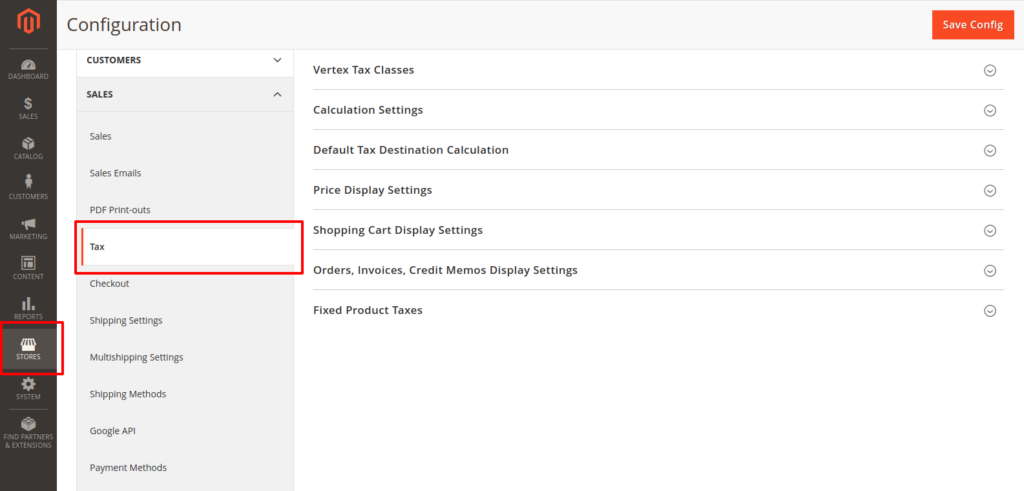

Go to Stores > Settings > Configurations > Sales > Tax.

To start with you need to have a look at the general tax settings such as Vertex Tax Class, Calculation, Price Display that are set up as “Use system value” by default.

After you make any changes please make it a habit to hit the SAVE CONFIG button.

For a multi-site configuration, set the Store View to the website and store, that as the target of the configuration.

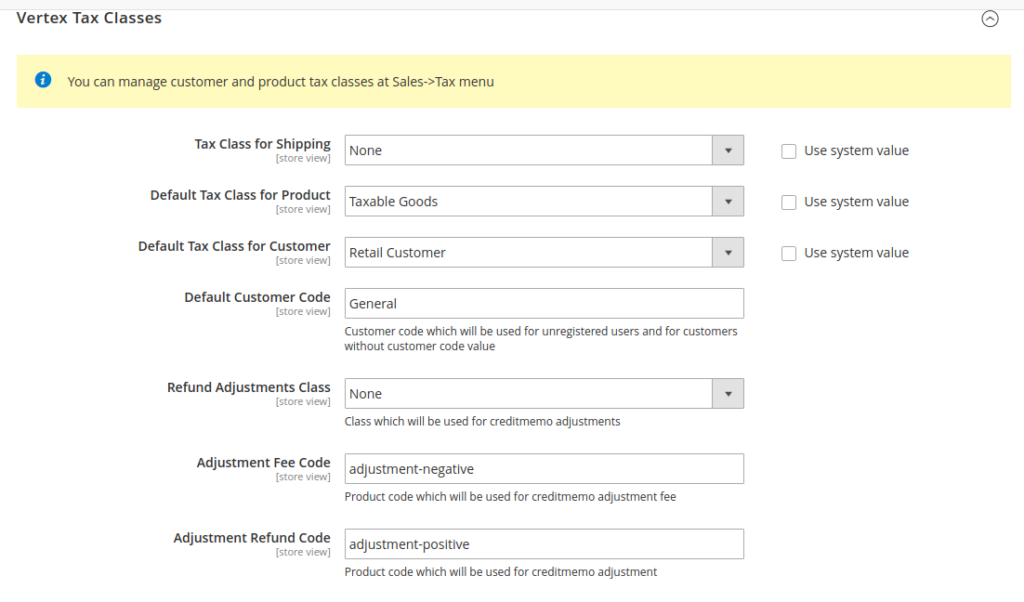

Vertex Tax Classes

Vertex Tax classes can be assigned to the customers, products, and shipping. Magento analyzes the shopping cart of each customer and calculates the appropriate tax according to the class of the customer, the class of the products in the cart, and the region (as determined by the customer’s shipping address, billing address or shipping origin). You can set tax class for Shipping and set default tax class for Product or the Customer. You can also set refund adjustment classes and refund code from here.

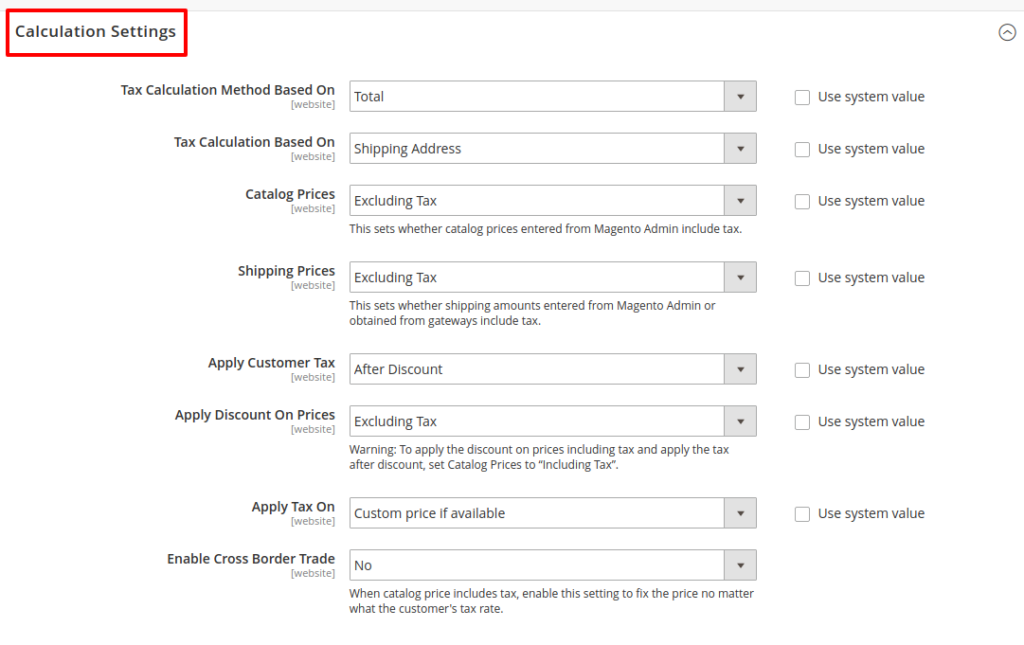

Calculation Settings

Determine the tax calculation method whether it is based on the unit price of the product, line item total, accounting for any discounts, or total. You can also determine if the tax based on the shipping address, billing address, or the shipping origin. Magento even allows users to set up Catalog Prices, Shipping Prices and Applying Discount on Prices to be included or excluded tax.

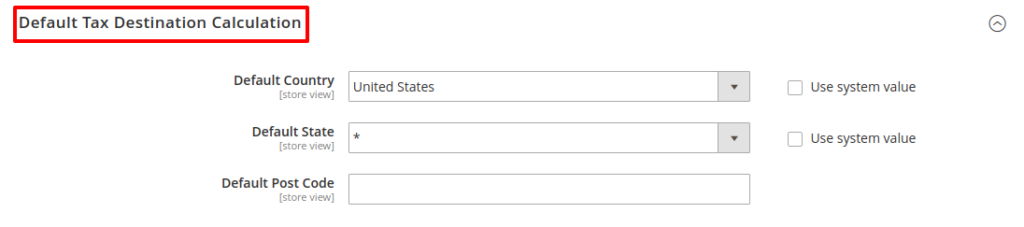

Default Tax Destination Calculation

The default tax destination settings determine the country, state, and ZIP or postal code that are used as the basis of tax calculations with the following settings: Default Country (the country upon which tax calculations are based), Default State (the state or province that is used as the basis of tax calculations), Default Post Code (the ZIP or postal code that is used as the basis of local tax calculations).

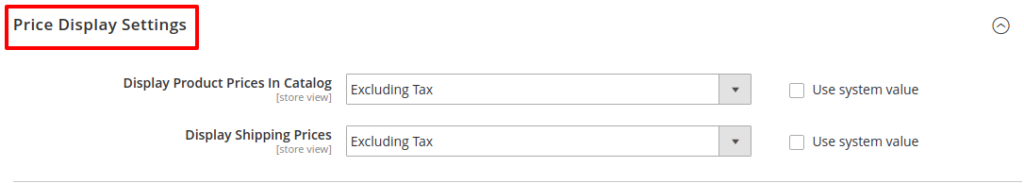

Price Display Settings

Price Display Settings determines if the product prices shown in the catalog and Shipping Prices includes the tax, excludes or displays both.

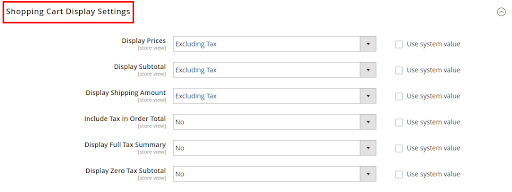

Shopping Cart Display Settings

Shopping cart display settings allow users to determine how the shopping cart displays prices, show the subtotal, and display the shipping amount either included or excluded from the tax, or show both. Users can include tax in the order total, display the full tax summary, or show a zero tax subtotal.

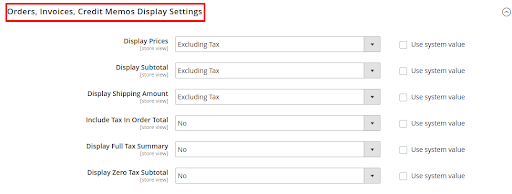

Orders, Invoices, Credit Memos Display Settings

Display Prices determines if the prices on sales documents include or excludes the tax, or if each document shows two versions of the price; one with, and the other without the tax.

Display Subtotal determines if the subtotal on sales documents includes or excludes the tax, or if each document shows two versions of the subtotal; one with, and the other without tax.

Show Shipping Amount determines if the shipping amount on sales documents includes or excludes the tax, or if each document shows two versions of the subtotal; one with, and the other without tax.

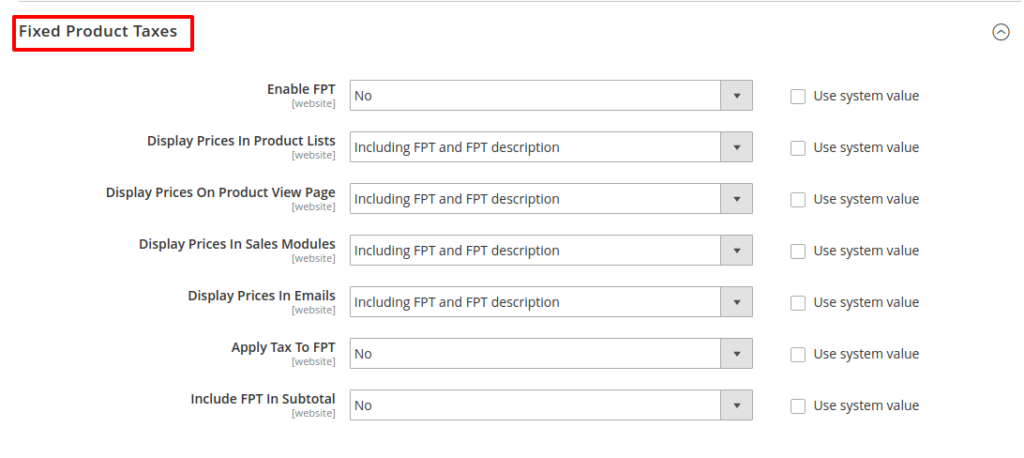

Fixed Product Taxes

Some tax jurisdictions have a fixed tax that must be added to certain types of products. You can set up a fixed product tax (FPT) as needed for your store’s tax calculations. This tax is a fixed amount, rather than a percentage of the product price.

Tax Rules

Tax rules incorporate a combination of product class, customer class and tax rate. Each customer is assigned to a customer class, and each product is assigned a product class. Magento analyzes the shopping cart of each customer and calculates the appropriate tax according to the customer and product classes, and the region (based on the customer’s shipping address, billing address or shipping origin).

Step 1: Complete the Tax Rule Information

- Fill in the required fields: Name, Tax Rate

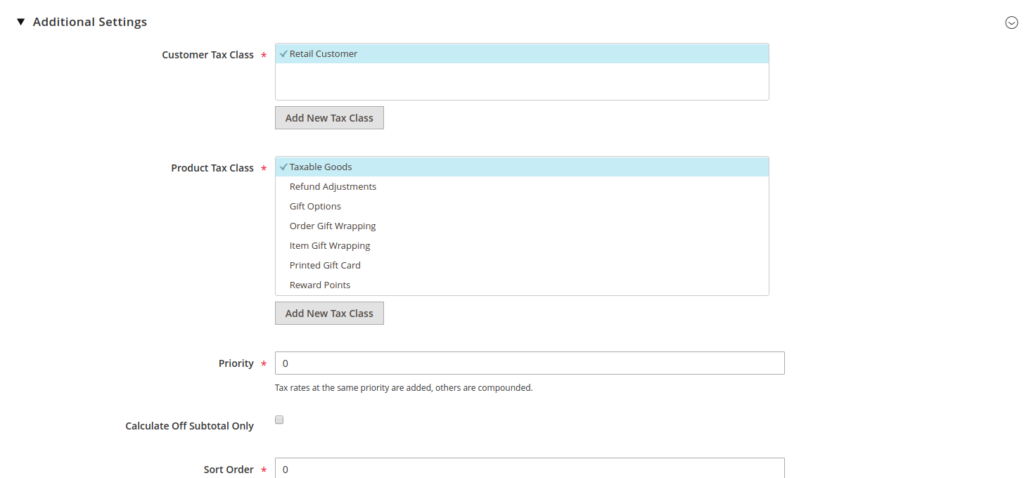

Step 2: Complete the Additional Settings

- Choose the Customer Tax Class

- To create a new tax class, tap Add New Tax Class. Complete the form as needed and Save.

- Choose the Product Tax Class

- To create a new tax class, tap Add New Tax Class. Complete the form as needed and Save.

- In the Priority field, enter a number to set the priority for each tax rule when multiple rules are active. If two tax rules share the same priority, Magento sums the taxes together. If two taxes have different priorities, Magento compounds the taxes.

- Select Calculate off Subtotal Only checkbox if you want the taxes to be based on the order subtotal.

- In the Sort Order field, enter a number to indicate the order of this tax rule when listed with others.

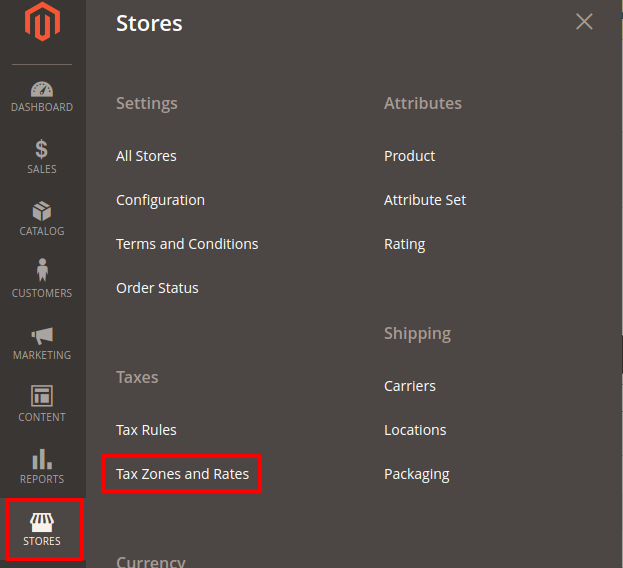

Tax Zones and Rates

Tax rates generally apply to transactions that take place within a specific geographical area. The Tax Zones and Rates tool enables you to specify the tax rate for each geographical area from which you collect and remit taxes. Because each tax zone and rate has a unique identifier, you can have multiple tax rates for a given geographic area (such as places that do not tax food or medicine but do tax other items).

Magento calculates store tax based on the store’s address. It then calculates the customer’s tax for an order after the customer provides their order information. Magento then calculates the tax based upon the tax configuration of the store.

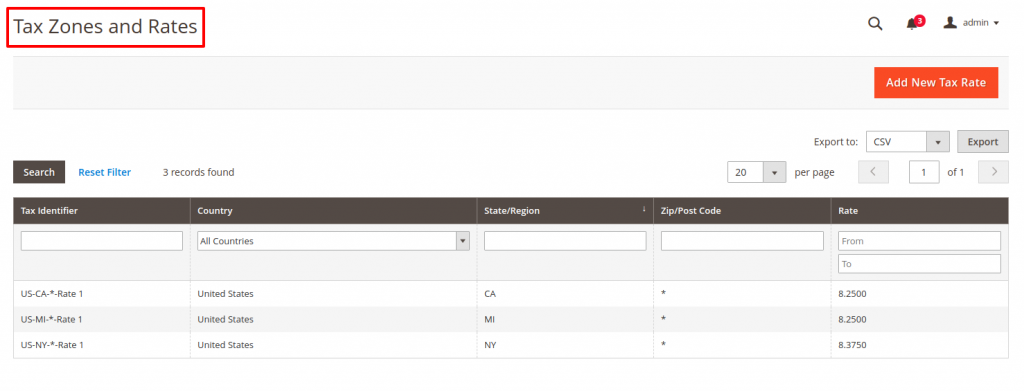

To set up a new tax rate:

- Enter the Tax Identifier, Zip/Post Code fields

- Choose the State and Country where you want to apply this tax rate

- Enter the Rate Percent that is used for the tax rate calculation

- Tap Save Rate when complete.

Learning how to set up tax rules in Magento 2 helps you manage taxes accurately for products, customers, and regions. By following these steps, you can create precise tax rules, streamline calculations, and ensure your Magento store remains fully compliant and efficient.

That’s it, fellas! We are done for today! Hope you find this article useful and you can Thank Us Later!

Post a Comment

Got a question? Have a feedback? Please feel free to leave your ideas, opinions, and questions in the comments section of our post! ❤️