10 Best Payment Gateways in the US in 2025

Rising online transactions across the United States have increased the number of payment gateways facilitating these transactions.

From robust fraud protection to smooth international transactions, a payment gateway saves you from many headaches. With an expected annual growth rate of 12.6%, they are a great asset in supporting the digital economy.

However, choosing the best payment gateway can be challenging — specifically when the industry, costs, sales volume, and overall payment needs differ for every business in the US.

And so, we’ve simplified the process for you. Our hand-picked payment gateways in the US will get you started soon!

Top 10 Payment Gateways in the US

- PayPal’s Payflow

- BlueSnap

- Stripe

- Square

- Adyen

- 2Checkout (Verifone)

- Braintree

- Authorize.net

- Worldpay (FIS)

- WePay

1. PayPal’s Payflow

PayPal is the first preference for small to midsize businesses. With 431 million users, it’s the top contender in our list as it works with any shopping cart, processor, and merchant account.

Through PayPal apps, it supports other functions of business – sending invoices, POS, and payment management. There’s also PayPal Credit which helps boost sales.

Designed to facilitate credit card transactions for e-commerce, it offers two services Payflow Link (based on needs) and Payflow Pro (based on customization).

Features

| Payment Methods | A variety of methods including credit/debit cards, PayPal Credit, ACH, and international payments |

| Registration Documents | Check here |

| Settlement Period | 2-3 business days |

| Mobile App Integration | SDKs for Android and APIs for iOS |

| Onboarding Time | Few days |

| Customer Support | Phone, email, community forums |

| eCommerce Platforms Supported | Shopify, Magento, WooCommerce, OpenCart, and many others |

| Other Integrations | CRM, ERP, Accounting Software, APIs |

| Security | PCI DSS compliant |

| Dashboard | User-friendly |

| Clients | Shopify, BigCommerce, Magento, Volusion |

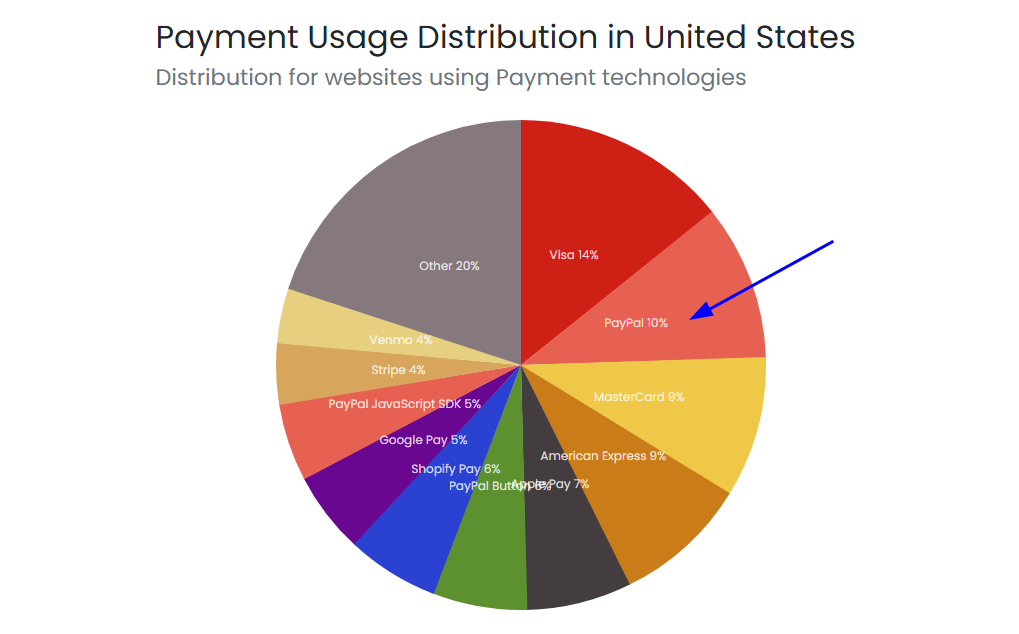

PayPal’s Payflow continues to dominate with around 10% of the U.S. market share for payment gateways.

Popular Payment Methods:

- PayPal

- Credit/Debit Cards

- Venmo

- Apple Pay

- Google Pay

If you want to accept Apple Pay, Google Pay, or Amazon Pay on PayPal’s Payflow, PayPal offers easy integration via its developer tools, APIs, and SDKs. Simply enable these methods within the PayPal manager portal.

Fees

- Payflow Pro Transaction – 10¢

- Payflow Link Transaction – 10¢

- Credit and Debit Card Payments – 2.99% + fixed fee

Pros

- 44% higher checkout conversion

- No setup or monthly fees

- Mobile-optimized checkout options

- Advanced reporting options

Cons

- Higher fees for lower volume

- Slow customer support

- Restricts migration of customer data

2. BlueSnap

BlueSnap’s Global Payment Orchestration Platform allows customers to optimize their payments and benefit from modular value-added services on a global scale. BlueSnap’s platform is a great choice for mid-market and enterprise organizations alike, providing global payment capabilities, embedded payments, and Payfac-as-a-Service solutions as well as invoicing and billing automation.

This platform gets high marks for how easily it integrates with many popular eCommerce platforms, accounting software, and CRM & ERP systems. It also offers a robust feature set, including a fraud prevention system powered by machine learning, unified analytics, and reporting and payment optimization tools.

Features

| Payment Methods | Major credit & debit cards, popular eWallets, direct debit methods and alternative payments |

| Registration Documents | Read here |

| Settlement Period | 2-5 business days |

| Mobile App Integration | Hosted and APIs |

| Onboarding Time | 1+ days |

| Customer Support | Phone, email, web portal |

| eCommerce Platforms Supported | NetSuite, BigCommerce, Chargebee, Zuora, Sage Intacct and many others |

| Other Integrations | 100+ Pre-Built Integrations with major platforms and popular software |

| Security | PCI DSS compliant |

| Dashboard | User-friendly, customizable |

| Clients | Roof Maxx, ABB, Ford Credit, Outbrain, Veracross, Edible, Adams Outdoor Advertising |

As a newer payment gateway in the U.S., BlueSnap currently holds a limited market share. However, it is experiencing rapid growth due to its innovative features, strong fraud protection, and adaptability to various business needs.

Popular Payment Methods:

- Credit/Debit Cards

- PayPal

- Apple Pay

- Google Pay

- Amazon Pay

BlueSnap offers built-in integrations with major payment methods like Apple Pay and Google Pay. Through its intelligent payment platform, merchants can easily enable these methods with minimal setup using its user-friendly dashboard.

Fees

- Quick-start pricing Transaction fees — 2.9% to 3.9% + 30¢

Custom pricing available — More Details

Pros

- Single integration

- One contract and one account to sell globally

- Local card acquisition in 47 countries

- Ability to accept payments globally with 100+ payment types and currencies

- Built-in tax solutions to ensure compliance with local requirements

- Peer to peer support

Cons

- May not be well-suited for startups and small businesses

- Works best for multi-entity businesses

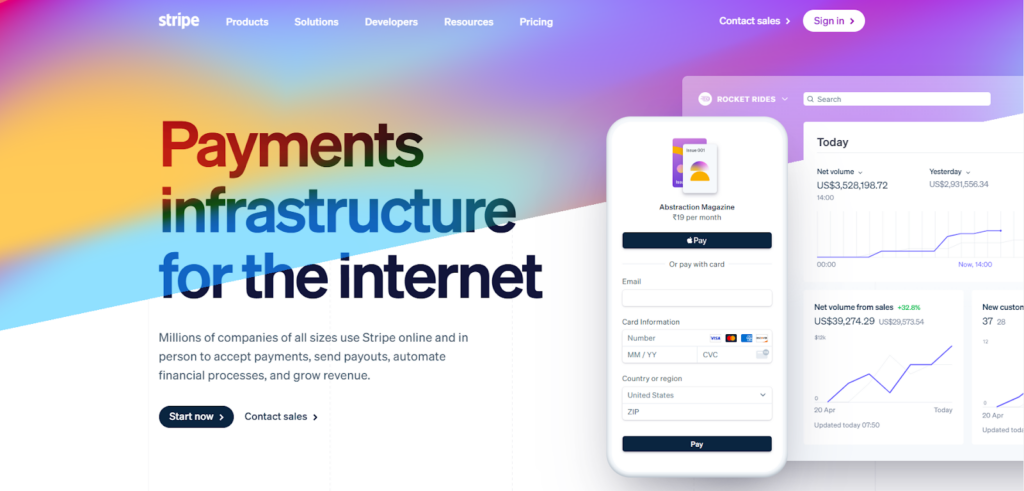

3. Stripe

A complete payment platform for eCommerce, Stripe is a versatile payment gateway with global reach. Best for handling recurring subscriptions and on-demand marketplaces, Stripe is a preferred choice due to ease of integration, innovative tools and services, and scalability.

Its optimizations, improved authorization, and automation make it a convenient and preferred method. It offers 3 different types of checkout – flexible and brand checkout, shareable payment link, and prebuilt payment form.

Features

| Payment Methods | Credit/debit cards, PayPal Credit, ACH, and international payments |

| Registration Documents | Check here |

| Settlement Period | T +3 |

| Mobile App Integration | SDKs for Android and APIs for iOS |

| Onboarding Time | Few minutes |

| Customer Support | Chat, phone, email |

| eCommerce Platforms Supported | Shopify, Wix, WooCommerce, Squarespace, and many others |

| Other Integrations | CRM, ERP, Accounting Software, APIs |

| Security | PCI DSS compliant |

| Dashboard | User-friendly |

| Clients | Amazon, Google, Salesforce, BMW, Zara, etc. |

Stripe is a leader in the U.S. market, holding over 4% of the market share, especially favored by tech-savvy startups and global enterprises.

Popular Payment Methods:

- Credit/Debit Cards

- Apple Pay

- Google Pay

- ACH Direct Debit

- Alipay

Stripe supports Apple Pay and Google Pay directly via its API integration. Businesses can also enable one-click payments for customers on their sites, optimizing the experience for both mobile and web platforms.

Fees

- Cards, wallets, and links — 2.9% + 30¢

- Bank debits and transfers — 0.8%

Pros

- Quick, easy setup with low cost

- Suitable for small businesses and startups

- Faster, one-click checkout

- Unified experience across online and in-person channels

Cons

- Expensive plans

- Challenging for beginners

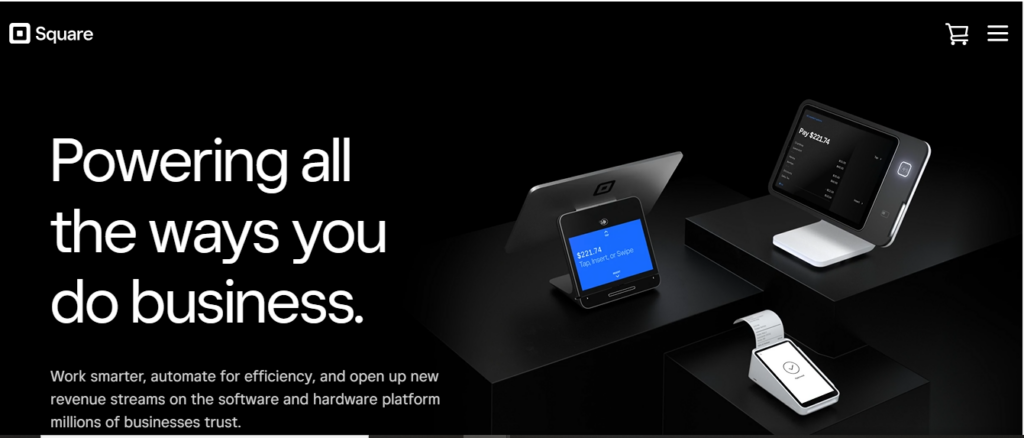

4. Square

From a mobile card reader to a comprehensive Point-of-Sale (POS) system, Square became a popular choice for SMEs. The wide range of features makes it suitable for various types of business. From inventory management to customer engagement, it provides tools for payment processing, building customer loyalty, and employee management.

Its specialization lies in providing free sites so that businesses can build an online presence without any tech skills or cost.

| Payment Methods | Credit/debit cards, digital wallets, bank transfers, AfterPay, and Square invoices. |

| Registration Documents | Read here |

| Settlement Period | 1-2 business days |

| Mobile App Integration | POS |

| Onboarding Time | Instant |

| Customer Support | Phone, email, social media |

| eCommerce Platforms Supported | Square Online, Wix, WooCommerce, BigCommerce, Magento, |

| Other Integrations | Various tools and platforms like CRM |

| Security | PCI DSS compliant |

| Dashboard | User-friendly |

| Clients | Blue Bottle Coffee, Sweetgreen, Glossier |

Square commands a significant share of about 8% of the U.S. market, particularly among small to medium-sized businesses.

Popular Payment Methods:

- Credit/Debit Cards

- Apple Pay

- Google Pay

- Bitcoin (Crypto)

- Cash App

Square’s mobile app and point-of-sale systems easily integrate Apple Pay and Google Pay. These methods can be added to both online stores and in-person payments through Square’s reader devices.

Fees

- Online Transactions — 2.9% + 30¢

- ACH bank transfer — $1-$5

- Subscription payments — 2.9% + 30¢

- For businesses processing $250k+ per year — Custom quote

Pros

- Clear, transparent pricing

- Flexible hardware options

- Impressive features

- No fees for chargebacks

Cons

- Incompatible for Windows devices

- Limited version for specialized industries

5. Adyen

Adyen is a global, developer-friendly, hassle-free, and streamlined payment gateway catering to 30+ currencies and countries worldwide for mobile, online, and in-store transactions. It is appealing for tech-savvy, small to mid-sized businesses for moderate price, instant support, and innovative working policy.

Store owners can create customized payment experiences and use AI to detect fraud. Its global reach makes it a premier e-commerce solution.

Features

| Payment Methods | Multi options including credit/debit cards, digital wallets, bank transfers, gift cards, etc. |

| Registration Documents | Read here |

| Settlement Period | Daily, Weekly, Monthly |

| Mobile App Integration | SDKs and APIs |

| Onboarding Time | Few days |

| Customer Support | 24/7 phone support |

| eCommerce Platforms Supported | Shopify, Magento, WooCommerce, BigCommerce, Salesforce, and many others |

| Other Integrations | 77 local and 27 local in-person payment integration |

| Security | PCI DSS compliant |

| Dashboard | User-friendly |

| Clients | Uber, Spotify, eBay, Microsoft, Airbnb, and Netflix |

Adyen holds a significant 9% of the global payment gateway market, providing services to large businesses like Spotify and eBay.

Popular Payment Methods:

- Credit/Debit Cards

- Apple Pay

- Google Pay

- SEPA Direct Debit

- PayPal

Adyen’s global payment platform supports both Apple Pay and Google Pay through simple API integration. Merchants can choose specific countries and regions to enable payment methods as per local preferences.

Fees

- Visa and Mastercard – Interchange + 0.60% + 13¢

- American Express – 3.3% + 23¢

- Other payment methods – 3-12% +13¢

- ACH Direct payment – 40¢

Pros

- Diverse payment methods

- Robust fraud detection

- Flexible multichannel features and support

- Analytics for better decision-making

- Test account available

Cons

- Complex price structure

- Minimum monthly sales invoice required

- Challenging technical integration

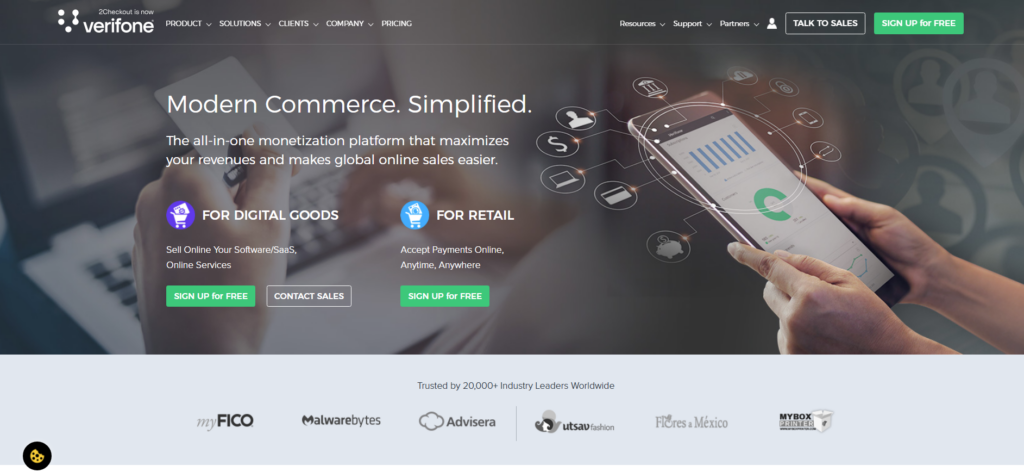

6. 2Checkout (Verifone)

Verifone took over 2Checkout in 2020. It is a preferred choice for online businesses that sell physical or digital products, tech startups, and subscription sellers for both small and large enterprises. It simplifies the complexities of online transactions, enhancing customer experiences.

There are two flexible payment models – payment service provider and merchant of record. Companies can decide which is the best of the two, depending on their business.

Features

| Payment Methods | Various credit/debit cards, PayPal, and other local methods |

| Registration Documents | Read here |

| Settlement Period | 1-7 days |

| Mobile App Integration | SDKs and APIs |

| Onboarding Time | Few days |

| Customer Support | Phone, email, chat |

| eCommerce Platforms Supported | Shopify, Magento, WooCommerce, BigCommerce, and others |

| Other Integrations | Accounting software, CRM |

| Security | PCI DSS compliant |

| Dashboard | User-friendly |

| Clients | SurveyMonkey, Bitdefender, SaaS companies |

2Checkout holds around 4-5% of the U.S. market, popular among digital goods merchants and international sellers.

Popular Payment Methods:

- Credit/Debit Cards

- PayPal

- Apple Pay

- Google Pay

- Amazon Pay

2Checkout makes it easy to enable Apple Pay, Google Pay, and Amazon Pay via their integration wizard. It’s as simple as connecting the accounts and enabling these methods within the platform’s dashboard.

Fees

- 2Sell Plan – 3.5% +35¢

- 2Subscribe Plan – 4.5% + 45¢

Pros

- Most reliable for subscription-based businesses

- Global reach, accepting 87+ currencies

- Advanced fraud detection and prevention

- Supports multiple languages

Cons

- Standard fees irrespective of transaction volume

- Holds funds or sudden termination affecting operations

7. Braintree

Braintree, a PayPal-owned payment gateway, is a versatile and developer-friendly solution for businesses of all sizes. Known for its seamless integration and global reach, it supports a wide range of payment methods, making it a popular choice for modern eCommerce platforms and mobile applications.

Braintree offers both a full-stack payment solution (including a merchant account) and a standalone gateway option, catering to diverse business needs. Its transparent pricing, robust security features, and advanced tools for fraud prevention make it a trusted choice for businesses looking to scale internationally.

Features

| Payment Methods | Credit/debit cards, PayPal, Venmo, Apple Pay, Google Pay, ACH Direct Debit |

| Registration Documents | Read here |

| Settlement Period | 12-3 business days |

| Mobile App Integration | SDKs and APIs |

| Onboarding Time | Few days |

| Customer Support | Email, phone |

| eCommerce Platforms Supported | Shopify, Magento, WooCommerce, BigCommerce, Salesforce, and more |

| Other Integrations | Accounting software, CRM, third-party application |

| Security | PCI DSS Level 1 compliance, tokenization, and advanced fraud detection |

| Dashboard | Intuitive and customizable |

| Clients | Uber, Airbnb, GitHub |

Braintree, a PayPal subsidiary, has about 5-6% of the U.S. market share, and is a favorite among mobile-first businesses like Uber.

Popular Payment Methods:

- Credit/Debit Cards

- PayPal

- Apple Pay

- Google Pay

- Venmo

Braintree allows easy activation of Apple Pay, Google Pay, and Venmo directly via its API. The platform also allows merchants to accept these methods in both in-app and web-based payment flows.

Fees

- Standard Rate: 2.9% + 30¢ per transaction

- ACH Payments: 0.75% per transaction

- Additional fees may apply for currency conversion and international payments.

Pros

- Easy integration with detailed developer tools

- Supports multiple payment methods and currencies

- Transparent pricing with no hidden fees

- Global scalability with advanced fraud protection

Cons

- Settlement period may vary for certain payment methods

- Require technical expertise for implementation

8. Authorize.net

This Visa-owned payment gateway is the best choice for Magento-powered websites. It accepts various payment methods online – including Apple Pay and eChecks. With extensive features, it offers reliable payment processing and 24/7 support.

It provides an all-in-one plan including both a merchant account and payment gateway or as a standalone gateway. It caters to different business requirements and gives flexibility and pricing transparency.

Authorize.net also provides the freedom to work with other merchant account providers and high-risk accounts.

Features

| Payment Methods | Credit/debit cards, ACH payments |

| Registration Documents | Read here |

| Settlement Period | 1-2 business days |

| Mobile App Integration | SDKs and APIs |

| Onboarding Time | Few days |

| Customer Support | Email, phone |

| eCommerce Platforms Supported | Shopify, Magento, WooCommerce, BigCommerce, Salesforce, and many others |

| Other Integrations | Accounting software, CRM, third-party application |

| Security | PCI DSS compliant |

| Dashboard | User-friendly |

| Clients | TicketMaster, Dell, GoDaddy |

Authorize.net commands around 5% of the U.S. market share and has been a long-standing player in the payment gateway industry.

Popular Payment Methods:

- Credit/Debit Cards

- Apple Pay

- Google Pay

- ACH Payments

Authorize.net provides integrations with Apple Pay and Google Pay through its simple plugin system for eCommerce platforms like WooCommerce and Magento. Just enable these payment methods in the dashboard for immediate use.

Fees

- Merchant Account – 2.9% + 30¢

- Payment Gateway only – 10 ¢/transaction + 10¢ daily batch fee

Pros

- No termination fees

- Strong security and fraud detection

- Streamlined payment process

Cons

- Time-consuming implementation

- Higher fees apart from transaction costs

9. Worldpay (FIS)

For large enterprises dealing with high-volume transactions, Worldpay is a scalable solution. It offers comprehensive solutions for both in-person and online transactions. Spread across 146 countries and supporting 300+ payment methods, it serves various industries including retail, hospitality, and e-commerce.

Worldpay accepts card payments, online or in-store, without any hardware. It protects from data breaches, giving robust security.

Features

| Payment Methods | Various credit/debit cards, ACH payments, digital wallets |

| Registration Documents | Know here |

| Settlement Period | Next day |

| Mobile App Integration | Own mobile app |

| Onboarding Time | Few days |

| Customer Support | 24/7 phone support |

| eCommerce Platforms Supported | Shopify, BigCommerce, Magento, and many others |

| Other Integrations | POS, Accounting Software, CRM |

| Security | PCI compliance |

| Dashboard | Flexible |

| Clients | Airbnb, Spotify, Etsy, Hotels.com |

Worldpay holds around 7% of the U.S. market, with a strong presence in the global payment landscape.

Popular Payment Methods:

- Credit/Debit Cards

- Apple Pay

- Google Pay

- ACH Payments

Worldpay supports Apple Pay and Google Pay integration seamlessly with its RESTful APIs and SDKs. It allows businesses to enable both in-store and online payments without much hassle.

Fees

- Payment Processing – Quote-based

- Hardware Cost – Based on third-party providers

Pros

- Strong customer support

- Seamless global transactions

- Flexible with integrations

- Supports 126 currencies

Cons

- Lacks transparent pricing

- Confusing, time-consuming interface

10. WePay

WePay is a payment service provider partnering with independent software platforms and vendors. It targets small and medium-sized businesses, nonprofits, and crowdfunding platforms.

The platform provides customized payment solutions to clients on checkout experiences and fraud protection along with easy integration with popular eCommerce platforms and fundraising websites.

It offers 3 products – Clear, Link, and Core for different payment needs.

Features

| Payment Methods | Major credit/debit cards, digital wallets, mobile payments, compatible card readers |

| Registration Documents | Know here |

| Settlement Period | Daily, Weekly, Monthly |

| Mobile App Integration | Compatible card readers |

| Onboarding Time | Instant |

| Customer Support | |

| eCommerce Platforms Supported | Shopify, WooCommerce, BigCommerce, Magento, Wix, Squarespace, and many others |

| Other Integrations | Accounting Software, CRM |

| Security | PCI DSS compliance |

| Dashboard | User-friendly |

| Clients | GoFundMe, Constant Contact, FreshBooks, Meetup |

WePay has a smaller but growing market share of around 2% in the U.S., mainly providing solutions to marketplace and platform businesses.

Popular Payment Methods:

- Credit/Debit Cards

- Apple Pay

- Google Pay

- ACH Payments

WePay offers easy-to-implement integrations for Apple Pay and Google Pay via its SDKs and APIs. Marketplace and platform owners can integrate these methods into their custom solutions quickly.

Fees

- Credit Card Transaction (for new US businesses) – 2.9% + 25¢

- Merchant Platforms – 2.9% + 30¢

- In-person Transactions – 2.6% +10¢

Pros

- Easy, seamless integration

- Highly convenient

- Customized and personalized solutions

- Good customer support

- No setup fees

Cons

- High processing cost

- Lacks phone support, only email support is available

- Only for businesses with WePay platform partners

So, the list of top payment gateways ends here. We’ve tried to gather all the required information for you to make a better selection. But, still, if you find it difficult to analyze them, we have an easy way for you in the next section.

Comparison: Best Payment Gateways in the US

To make your decision easier, we’ve compiled a detailed comparison of some of the most popular payment gateways in the U.S. This section highlights essential features, global reach, and the unique strengths of each provider.

Here is the quick comparison table to find the best Payment Gateways in the US. Take a closer look to identify the payment gateway that aligns perfectly with your business goals, operational requirements, and customer preferences.

| Feature | PayPal’s Payflow | BlueSnap | Stripe | Square | Adyen | 2Checkout (Verifone) | Braintree | Authorize.net | Worldpay (FIS) | WePay |

| Global Reach | ✔️ | ✔️ | ✔️ | ❌ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ❌ |

| Currencies Supported | ✔️ | ✔️ | ✔️ | ❌ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ❌ |

| Fraud Protection | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ |

| Recurring Payments | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ |

| Ease of Integration | ✔️ | ✔️ | ✔️ | ✔️ | ❌ | ✔️ | ✔️ | ✔️ | ❌ | ✔️ |

| Customizability | ❌ | ✔️ | ✔️ | ❌ | ✔️ | ✔️ | ✔️ | ❌ | ✔️ | ❌ |

| Chargeback Handling | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ |

| Payout Flexibility | ❌ | ✔️ | ✔️ | ✔️ | ✔️ | ❌ | ✔️ | ❌ | ✔️ | ❌ |

| Reporting & Analytics | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ |

| Multi-Language Support | ✔️ | ✔️ | ✔️ | ❌ | ✔️ | ✔️ | ✔️ | ❌ | ✔️ | ❌ |

| Subscription Billing | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ |

| Buy Now, Pay Later Options | ✔️ | ❌ | ✔️ | ❌ | ✔️ | ❌ | ✔️ | ❌ | ✔️ | ❌ |

Our table offers a side-by-side comparison of gateways like PayPal’s Payflow, Stripe, Square, and Adyen, among others. Each gateway brings its own strengths to the table, catering to diverse business needs—from small startups to large enterprises.

The ideal payment gateway enhances your business operations, provides a seamless customer experience, and supports your growth ambitions.

Now that you’ve seen the comparison table, the next step is figuring out which payment gateway fits your business best. This depends on what you need—whether it’s ease of use, global reach, advanced security, or specific payment options.

Which Payment Gateway Should You Select for Your Business?

A payment gateway is crucial for the success of your business because a streamlined payment process enhances customer satisfaction. When choosing one for your business, decide on important factors like business size, industry, needs, payment methods, features, and integration among others.

As a small business, you can start with PayPal, Stripe, or Square. But if your business has slightly different requirements, you’ll need customized solutions. Making informed decisions will improve transaction efficiency and overall financial operations.

Still unsure? Let us help you out!

We help businesses like yours pick the perfect payment gateway based on what you need—whether it’s specific payment methods, easy checkout, or seamless integration with your store.

Here’s how we can help:

- Customize the payment process to match your store’s branding and customer experience.

- Recommend the best gateway for your business.

- Handle the integration, so you don’t have to worry about the technical stuff.

Reach out to our team today and take the first step toward creating a frictionless payment experience for your customers.

More resources:

Post a Comment

Got a question? Have a feedback? Please feel free to leave your ideas, opinions, and questions in the comments section of our post! ❤️