10 Best Payment Methods for Shopify Store

As a Shopify merchant, you have tonnes of online as well as offline payment options for getting payments from your customers. But too many options may give you confusion as well. If this is the exact case with you, don’t worry. You are on the right tab!

In this post, we’ll take a look at the most popular payment methods for Shopify stores, as well as a few things to consider while choosing the Shopify payment gateways. In short, we’ll help you to figure out the best payment methods for your Shopify store.

Yes, I am saying “payment methods” because Shopify store owners are privileged to add multiple payment providers and unlock more convenient payment options for their customers. Therefore, if you don’t want to lose the second-best or the third-best payment method, you can easily enable multiple payment methods in your Shopify store.

So, let’s get started!

10 Best Shopify Payment Methods

The Internet is a vast place, and you need to make sure you have the right way to sell your products. Luckily, Shopify has a variety of payment methods that will work for your store.

Here, you will see various types of online payment providers such as payment gateways and accelerated checkout providers.

Here are the 10 Best Shopify Payment Methods:

- Shopify Payments

- PayPal payments

- Google Pay

- Stripe

- Apple Pay

- Amazon Pay

- Authorize.net

- CyberSource

- Shop Pay

- Meta Pay

Let’s explore the best payment methods for your online store as well as your customers.

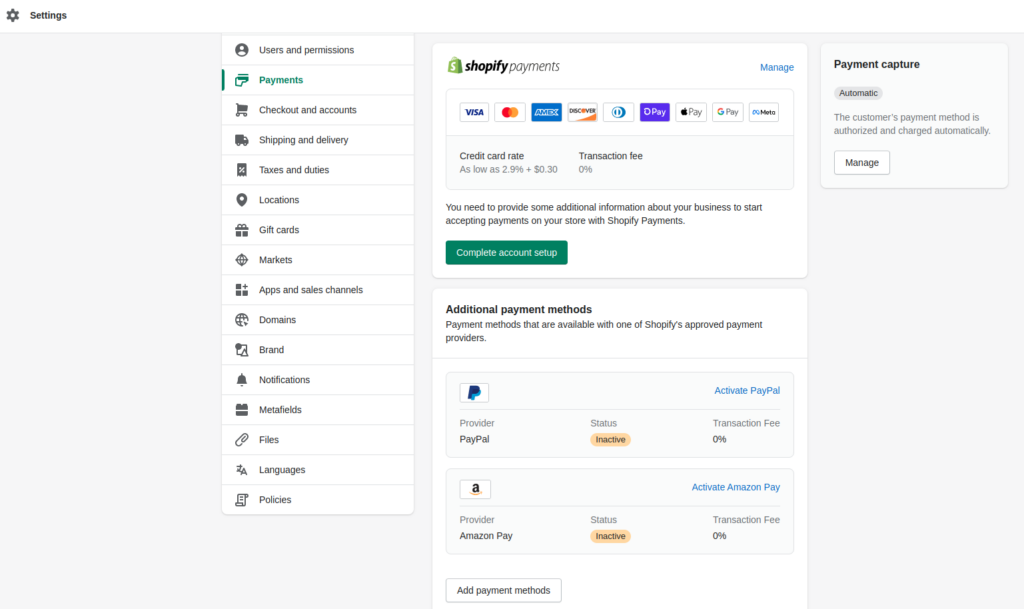

1. Shopify Payments

Provider type: Payment gateway

“Shopify payments” is the first preference for many reasons. Before I begin with the reasons, let’s first know what is Shopify payments.

Shopify Payments is a popular Shopify payment gateway with almost all digital payment services. It is a secure online payment solution that’s available to all Shopify merchants. This is the easiest and most popular payment method for accepting credit cards online, especially if you’re looking for something that works with your existing merchant accounts or can be easily integrated with them.

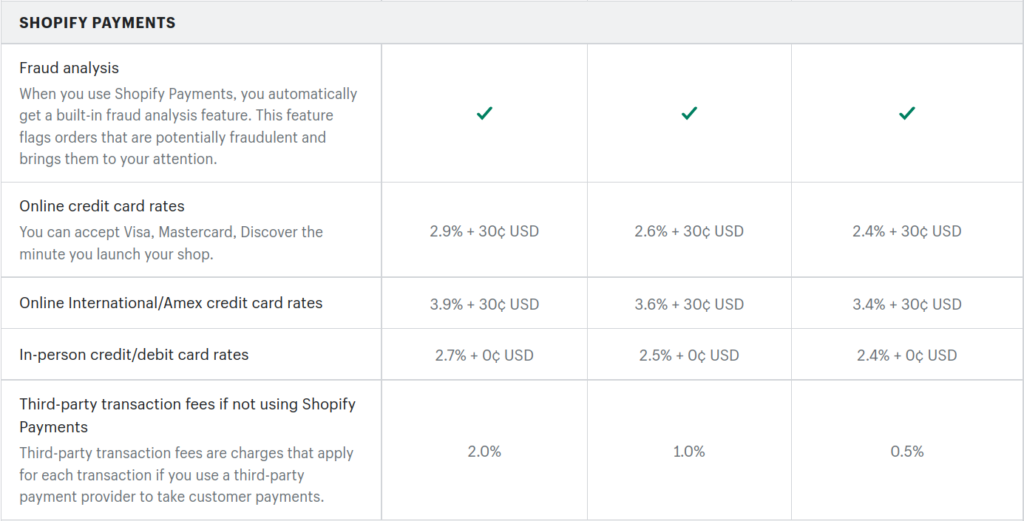

Pricing

Source: Shopify

Key benefits

- Shopify Payments belongs to the Shopify platform that saves you from complex integrations.

- You save up to 2% transaction fees on the third-party payment gateways if you use Shopify Payments.

- It offers automatic fraud analysis on your store orders.

- With Shopify payments, you can easily track your payments.

- It has lower processing fees compared to other payment gateways.

- It lets you accept the customer’s local currencies for shopping and supports automatic currency conversion.

- It power-ups your store with 3D Secure checkouts.

- Shopify payments help you buy shipping labels directly from Shopify.

- By activating Shopify Payment, you are eligible to get Shipping insurance of up to $200 (when using Shopify Shipping in your store).

Downsides

- Shopify payments is not available to stores in certain countries.

- You may not get the payment immediately.

Learn more about Shopify Payments.

2. PayPal payments

Provider type: Payment gateway

The survey says, “51% of customers trust businesses more if PayPal is accepted”. That’s why PayPal is the most popular and trustworthy payment gateway for online stores.

PayPal is best suited for new stores and small businesses. That’s why, when you build a new Shopify store, you can find PayPal already added to payment settings. PayPal allows you to accept credit card payments and bank account payments, or PayPal balances for your Shopify store.

It offers hassle-free payment processing and it is the best third-party provider if you don’t want to use Shopify payments or you wish to give additional payment options to your customers.

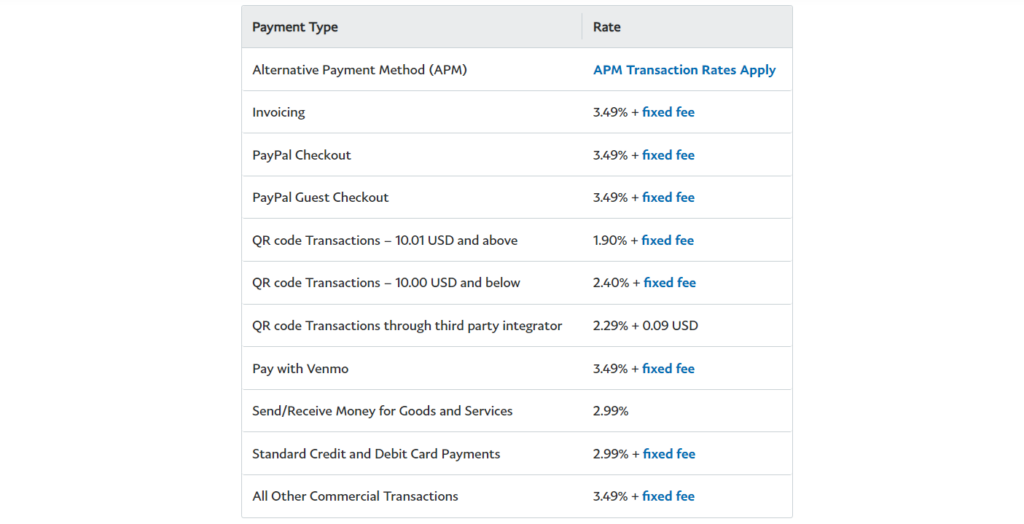

Pricing

PayPal charges vary based on the payment methods used. These are the standard rates for receiving domestic transactions (US) using PayPal. Here the “fixed fee” differs based on the currency received.

Source: PayPal

The PayPal fee for international commercial transactions is 1.50%.

Key benefits

- PayPal offers a dynamic checkout button for your shoppers for express checkout.

- You can sell your products worldwide using PayPal.

- It offers highly secure payment services.

- It helps you build your brand credibility and boost customers’ trust in your store.

- Almost every online shopper is using PayPal. So, it becomes convenient for customers to process payments quickly through their PayPal app.

- PayPal supports payments with multiple currencies.

- It helps you accept online payments from almost all countries.

- You can create automated invoices using the PayPal Payments system.

- The PayPal app provides strong financial reporting.

Downsides

- Getting customer support is quite difficult.

- The chargeback fees are high.

- Digital products are not covered by PayPal’s seller protection.

- High costs may apply to small transactions.

- PayPal Terms and conditions (T&C) breaches may result in account suspension.

- It can take 4-5 business days for withdrawn funds to clear in your bank account.

Learn more about PayPal Payments.

3. Google Pay

Provider type: Accelerated checkout

Google Pay (GPay) is a very popular medium of mobile payments nowadays. It provides an easy and secure way to pay bills or send money between GPay users.

With Google Pay, users don’t have to enter their card details manually during checkout. When the shoppers tap the Google Pay button (a dynamic checkout button), Google Pay sends the customer’s information to the payment provider (i.e. Shopify Payments).

In short, by enabling Google Pay in your Shopify store you can simplify the checkout process for your online shoppers.

Pricing

Using Google Pay is Free!

Let me explain – To avail Google Pay payment method for your customers, you need to first activate Shopify Payments in your store. Here, Shopify Payment is your payment gateway. Thus, as you are not using any third-party payment provider you don’t have to pay the “third-party transaction fees” to Shopify.

Key benefits

- Google Pay offers simple and seamless payment processing.

- It’s a secure platform and is trusted by users.

- It has great incentives rewards and cash back that motivates users to make payments.

- You can offer faster checkout to your customers.

- You don’t have to pay any extra fees for accepting Google Pay.

- The integration process is quite simple.

- Highly secured – Seller or receiver cannot see credit or debit card details.

Downsides

- The Google Pay button is visible only on a few browsers: Google Chrome, Mozilla Firefox, and UCWeb UC Browser.

- Google Pay isn’t available to merchants located in France.

- You must use any payment gateway to activate Google Pay in your store.

- Reaching out to their customer service is really hard.

4. Stripe

Provider type: Payment gateway

If you are a big eCommerce enterprise then you can add Stripe as your payment gateway for a more customized and personalized payment solution. The stripe is quickly expanding its global presence.

Today, merchants from almost all nations may easily access it. Because of its vast toolkit and simple yet effective features, Stripe helps make transactions less complicated. Stipe helps you accept debit and credit card payments as well as Automated Clearing House (ACH) transactions.

You can also set up recurring payments with Stripe so your customers don’t have to pay all at once and you don’t have to worry about them forgetting.

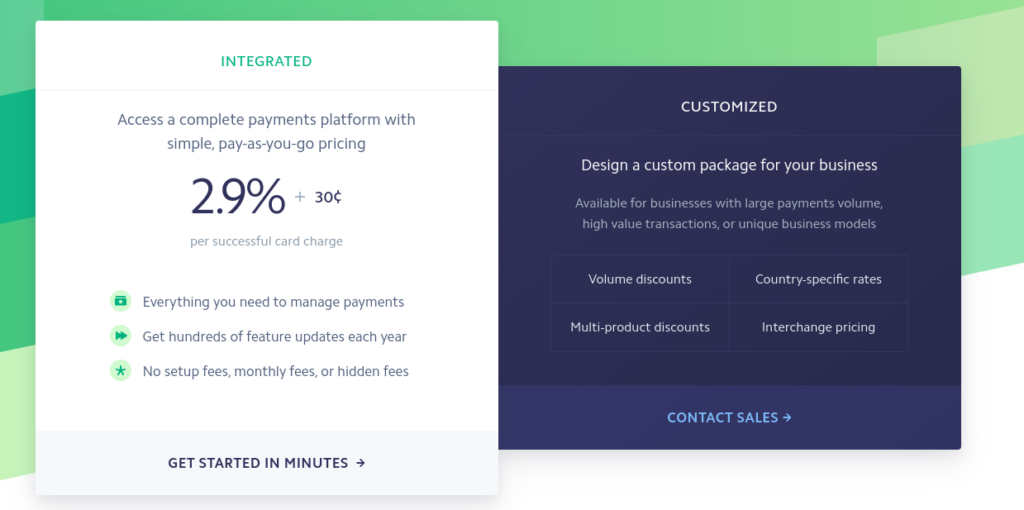

Pricing

Source: Stripe

You also have to pay an additional 1% for international card transactions and an extra 1% if you need currency conversion.

Key benefits

- It offers easy and quick integration.

- Stripe keeps the payment safe with dynamic 3D security.

- Over 135 different currencies are accepted by Stripe.

- 24/7 customer support is available via email, live chat, and phone.

- Stripe offers great options for your custom payment needs.

- You can customize the checkout flow using Stripe.

- Stripe gives you a wide range of payment options.

Downsides

- Stripe is expensive for small businesses.

- It is more developer-centric, thus difficult to understand.

- Stripe has limited functionalities for in-person payments.

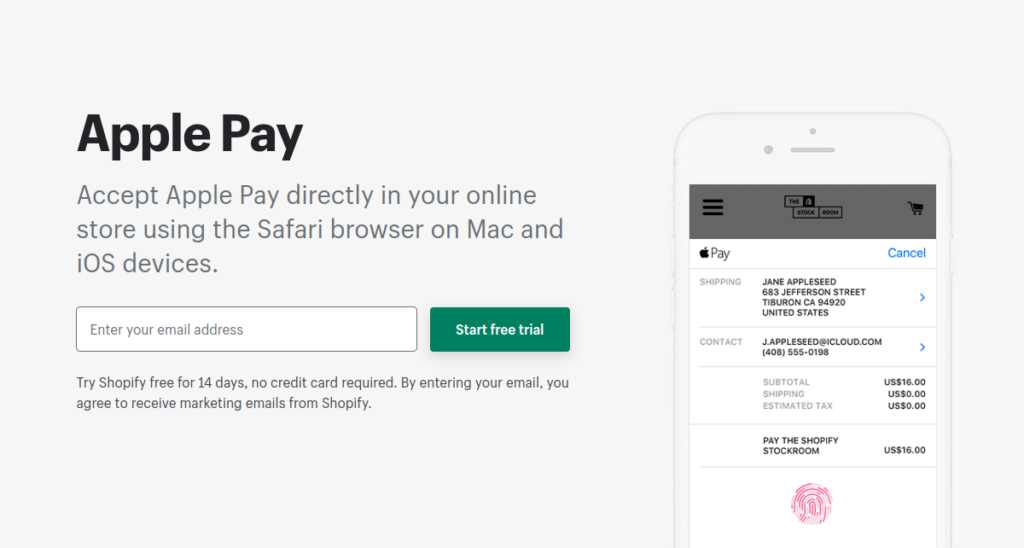

5. Apple Pay

Provider type: Accelerated checkout

Apple Pay helps you to offer a quick checkout option to shoppers who are Apple users. When the user browses your Shopify store using the Safari browser on their Mac or iOS device, they can tap the Apple Pay button (for dynamic checkout) and scan their fingerprint to process online payment transactions.

When customers choose this payment solution to make the purchase, they don’t have to enter their card details and shipping address. This way they can opt for super fast checkout!

Pricing

Accepting online payments using Apple Pay is free!

You just need to pay the transaction fees associated with the payment gateways for Shopify.

Key benefits

- It unlocks faster payment options for your customers

- It comes with an easy setup process.

- It auto-detects Apple users and offers them accelerated checkout.

- You don’t have to pay extra fees for using this online payment solution.

Downsides

- The dynamic checkout button is visible only when the customer is using the Safari browser on their Mac or iOS devices.

- Your domain must be SSL-certified.

- You must use any payment gateway or credit card payment provider to activate ApplePay in your store.

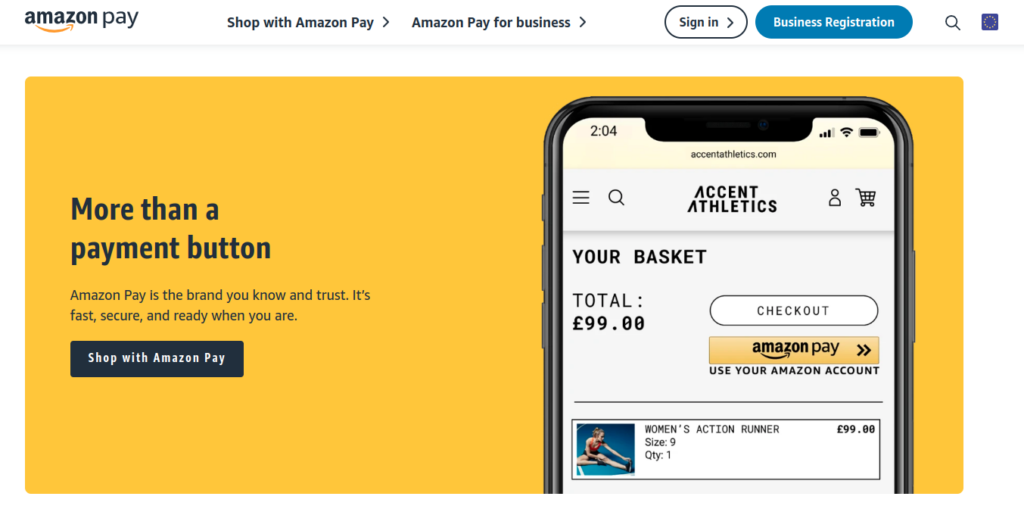

6. Amazon Pay

Provider type: Accelerated checkout

Amazon Pay is a popular payment method that provides a secure and convenient way to accept payments. It allows online payments using the card details and shipping details associated with the customer’s Amazon account. Therefore, customers don’t have to type their card information and shipping details to complete the checkout process.

Customers who use Amazon Pay can complete their transaction with a faster checkout by accessing the shipping address and payment information already in their Amazon account. Their billing address is kept confidential and is not given to Shopify.

If you want to see a jump in your conversion rate then you should consider adding this payment method to your online store.

Pricing

You have to pay Shopify third-party transaction fees, every time customers make a purchase using the payment method by Amazon.com.

Key benefits

- Amazon is the most trusted brand and it offers secured checkouts to your customers.

- It offers 49% faster payment processes than normal checkouts.

- You get data privacy with this payment method.

- You can place a dynamic checkout button on your product page.

- It reduces high-risk transactions and saves you from chargebacks.

- Excellent customer service that is prompt and simple to contact.

Downsides

- It does not support stores in many countries.

- It supports very limited currencies.

- It takes 2-3 business days to clear the payment.

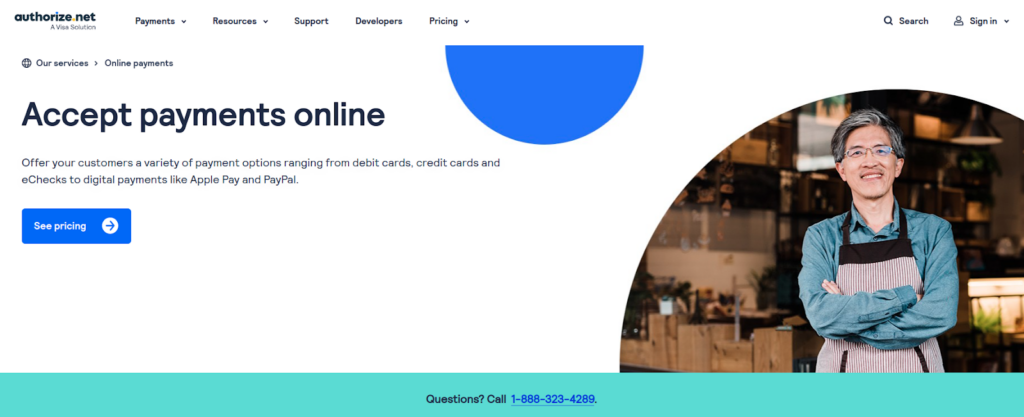

7. Authorize.net

Provider type: Payment gateway

If you’re looking for a simple payment solution that works with all major credit cards, Authorize.net is the best payment method for Shopify stores. It enables merchants to receive payments from customers using credit cards, debit cards, and other forms of payment such as PayPal and Google Wallet.

It has a wide range of features and capabilities such as advanced fraud detection and secure customer data storage that make it a great fit for any eCommerce store owner who wants to accept payments safely.

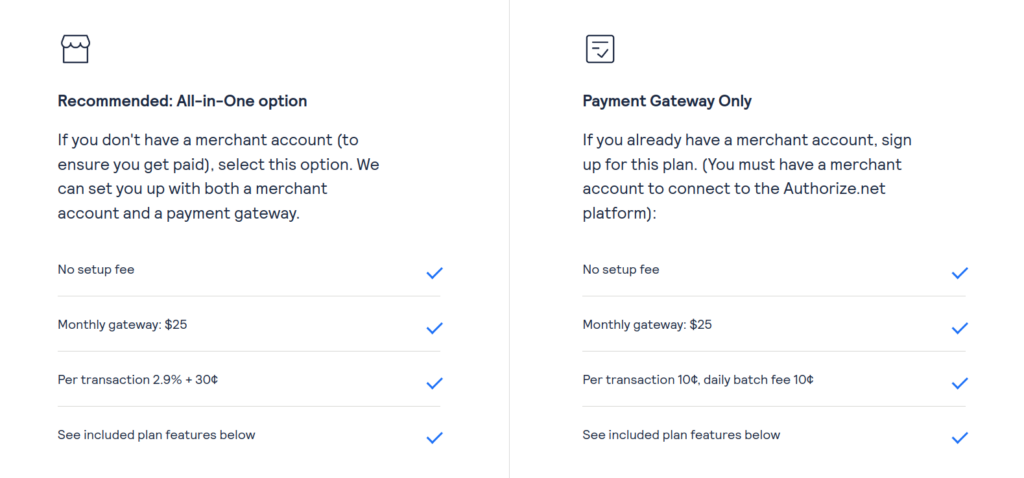

Pricing

Whichever plan you select, you have to pay flat monthly fee + transaction fees shown in the below image:

Source: Authorize.net

Key benefits

- This payment gateway saves your store from high-risk orders with advanced fraud protection. Also, you get alerts on suspicious transactions.

- It offers customization of the payment gateway.

- It processes payments with high data encryption security.

- You’ll get monthly statements on emails for easy tracking.

- All payments are quickly and automatically paid to your bank account.

- It processes transactions in many different currencies.

- Authorize.net does not limit the size of transactions.

- It has very reliable customer support, as easy as calling.

Downsides

- Authorize.net is very expensive for small businesses.

- It requires a separate merchant account.

- Setting up recurring payments is difficult.

- UI is not so user-friendly and attractive.

Learn more about Authorize.net.

8. CyberSource

Provider type: Payment gateway

CyberSource is one of the best and most reliable payment gateways for Shopify store owners. Single seamless integration of your online store with CyberSource offers various payment methods to accept online payments from around the world.

It power-ups the payment processing with high-level security to keep payment data secure and protect your business and customers from cyber risks. It has a variety of features that are beneficial to your business, one of them is “fraud management”.

This payment gateway provider filters out bad payment transactions for your eCommerce business and saves you from high-risk orders and chargebacks.

Pricing

CyberSource is the best option for big-volume, low-cost credit card processing. But, you need to contact CyberSource for the exact pricing.

Key benefits

- It excels in financial analysis.

- You can easily monitor the cash flow with CyberSource.

- It offers 3D secure payment processing.

- It provides fraud detection and prevention for your online store.

- It supports multi-currency and dynamic currency conversion.

Downsides

- It may not be sufficient for large organizations or websites with a great deal of complexity.

- Customer support is not up to the mark.

9. Shop Pay

Provider type: Accelerated checkout

As a Shopify merchant, you should also take the benefit of a simple and straightforward payment method by Shopify, i.e. Shop Pay. Shop Pay is an advanced payment solution that comes with top features for shoppers as well as eCommerce merchants.

Shop Pay provides a wide range of language and currency support to help you accept payments from international transactions. You can also add a dynamic checkout button using Shop Pay which will fasten the checkout process for your customers.

Using Shop Pay, customers not only can make the payment but also track their packages after purchase.

Pricing

You don’t have to pay Shopify third-party transaction fees when you’re using the Shop Pay payment method.

Key benefits

- It gives you various marketing automation tools to boost your sale.

- You can customize the checkout for a better shopping experience.

- Customers can track their shipments after purchase.

- Customers get 3% cashback (to their Shop Pay wallet) on the payment amount, which motivates them to make purchases.

- It lets customers save their payment details securely for future payments.

- You can use the Shop Pay button for selling on Google, Facebook, and Instagram.

Downsides

- To use Shop Pay, you need to activate Shopify Payments.

- Shop Pay is not available for stores in many countries.

10. Meta Pay

Provider type: Accelerated checkout

Meta Pay is a reliable payment solution by Facebook, which is now also known as “Facebook Pay”. You can easily activate Meta Pay in your online store and also place a dynamic button on your product pages to offer a faster checkout process for your customers.

If you currently sell on Facebook, you should set up Facebook Pay because it gives consumers such a quick option to finish their transactions.

Pricing

Facebook pay does not charge commissions or payment processing fees. You only have to pay the transaction fees associated with the payment gateway provider.

Key benefits

- Facebook Pay allows faster payment processing than regular checkouts.

- It offers the easiest way for your customers to make payments.

- You don’t have to compromise privacy, account, and data security with Facebook Pay.

- You can easily sell on Facebook and Instagram with the Facebook Pay button.

Downsides

- With Facebook Pay, you may compromise on customer service.

Learn more about Facebook Pay.

Shopify’s payment methods are a little on the more complex side. The merchant has to integrate a payment gateway, then set up recurring billing and ship it to your bank account. This can be a bit tricky to set up, especially if you’ve never done it before.

Need help?? Our Shopify experts can help you in integrating payment gateways in your store.

Commonly Asked Questions about Shopify Payment Providers

Here are some FAQs that may answer your doubts regarding Shopify payment.

1. What payment methods can I accept on Shopify?

You can use Shopify Payments or a third-party payment provider as your primary payment method if you wish to accept credit card payments from your consumers. Customers can also make payments without using a credit card via a number of other ways such as PayPal, Google Pay, Amazon Pay, Shop Pay, and more.

2. Which payment gateway is used in Shopify?

There are many payment gateways available to use for Shopify store owners like Shopify Payments, PayPal, Stripe, and many more. You need to select the best payment gateway solutions based on your business requirements.

3. How do I choose the payment provider in Shopify?

To choose the payment provider in Shopify, you can:

Now, here you can either activate Shopify Payments or PayPal or find third-party payment providers to accept payments online from your customers.

4. Do you need payment gateways for Shopify?

Yes. You need to integrate the Shopify Payment gateway or third-party payment gateways for Shopify to start accepting payments from your customers. You can also add various payment methods like PayPal, Google Pay, Shop Pay, Facebook Pay, and more that help your customers pay without using credit card or debit cards.

5. How much does Shopify charge per transaction?

Shopify charges transaction fees based on which Shopify plan you are using.

For the Basic plan, Shopify charges 2.9% + $0.30 fee per transaction for all online purchases and a 2.7% fee per transaction for physical purchases.

For the Shopify plan, they charge a 2.6% + $0.30 fee per transaction for all online purchases and a 2.5% fee per transaction for physical purchases.

For the Advanced plan, Shopify charges 2.4% + $0.30 fee per transaction for all online purchases and a 2.4% fee per transaction for physical purchases.

Moreover, Shopify can charge you an additional 2% fee per transaction for using a third-party payment gateway.

6. How long does Shopify hold your money?

The time Shopify holds your money (payout period) depends on:

7. Where does my Shopify money go?

Your Shopify money is transferred to the bank account you add to the Shopify payment gateways. Therefore, you should carefully enter the account details in Shopify Payments.

8. Is Shopify Payments better than Stripe?

Yes. Shopify Payments is better than Stripe because Shopify Payments is the payment provider by Shopify and Stipe is one of the third-party payment providers.

When you use Shopify Payments, you don’t have to pay the additional 2% transaction fee that you have to pay if you use Stripe or any other payment gateways for Shopify.

9. Do I need a PayPal account for Shopify?

Yes, you need a PayPal account if you want to activate PayPal in your Shopify store to accept payments from your customers.

10. Does Shopify accept PayPal?

Yes. Your Shopify store can accept PayPal as soon as you activate PayPal in your store.

Final Thoughts!

So, here you’ve seen different payment methods that can work for your Shopify store. Some of them are best suited for small businesses and some of them are for medium or large enterprises.

There are many things you should consider for finding the best payment gateways or payment methods for your Shopify business. You should always test different payment methods before making any final decision.

If you think, you need a piece of expert advice, we would be happy to share our years of eCommerce expertise with you. Talk to our Shopify experts now!

Moreover, if you are struggling with setting up your Shopify store, you can quickly refer to this Shopify store setup checklist and get your store ready for the first sale.

Post a Comment

Got a question? Have a feedback? Please feel free to leave your ideas, opinions, and questions in the comments section of our post! ❤️