What Is Shopify Payments? — Everything You Need to Know!!!

We all know that Shopify is an all-rounder. Whether you want a theme to design your Shopify front-end or need apps to integrate new functionalities, it has everything in-built.

And one of their in-built features is “Shopify Payments”.

From the time you came across the term Shopify Payments, you’ve list of doubts running across your head. And you’re hunting for answers on what it is, how it works, whether it is safe to use, any benefits or drawbacks, how it compares to other payment methods, and a lot more.

In this article, I’ll break down every information to you. At the end of this guide, you’ll have all your answers to whether Shopify Payments can be the go-to reliable payment solution for your Shopify store.

Let’s start with it.

What Is Shopify Payments?

Shopify Payments is Shopify’s very own payment service provider, working as its default payment gateway. The default integration of Shopify Payments saves you from having to enter third-party payment provider credentials individually in your Shopify store.

With Shopify Payments, you can accept payment quickly and almost instantly after signing up. You have the option to accept payments from major payment gateways, as well as in local ones – which works in favor of your customers as it allows them to choose between their preferred payment methods.

Shopify Payments supports Credit Cards, Debit Cards, Gift Cards, Shop Pay, Apple Pay, Amazon Pay, Google Pay, Paypal, Stripe, Adyen, and local methods like Klarna, Sofort, Ideal, EPS Payments, Bancontact, and more.

US businesses have a special privilege to accept these credit and debit cards through Shopify Payments:

- Visa

- American Express

- MasterCard

- Discover

- Diners Club

- Elo

- JCB

Lastly, Shopify Payments is supported in certain countries only and requires the activation of two-factor authentication on your Shopify account.

Now, we have a basic understanding of Shopify Payments, so let’s check to whom it is useful.

Who Can Use Shopify Payments?

It may seem straightforward that Shopify Payments can be used by Shopify merchants — and that’s true.

However, there are some restrictions. Shopify Payments is available to eligible merchants only. If you ask about the eligibility criteria, I’m explaining them right here.

- Your business must be located in a country supported by Shopify Payments. (Listed Below)

- Your business type and products should not be prohibited by Shopify’s rules

- You must follow all the applicable laws, regulations, and terms for your business and country

These are the eligibility criteria to use Shopify payments. Here, I’m listing countries supported by Shopify Payments so you can check if it is supported in your country or not.

| Countries Supported by Shopify Payments | ||

| Australia | Germany | Romania |

| Austria | Hong Kong | Singapore |

| Belgium | Ireland | Spain |

| Canada | Italy | Sweden |

| Czechia | Japan | Switzerland |

| Denmark | Netherlands | United Kingdom |

| Finland | New Zealand | United States |

| France | Portugal | Puerto Rico* |

* Shopify Payments is available in Puerto Rico as it is considered a territory of the United States.

Moreover, You can keep track of the latest information on supported countries here.

Until now, you must be well aware of whether it works in your country or not. So now, let’s dive deeper to understand the nitty-gritty of how Shopify Payments works.

How Does Shopify Payments Work?

Shopify Payments has a straightforward process for the transfer of funds.

First of all, let me mention that Shopify Payments uses the Stripe processing system on its backend. So, simply, we can state Shopify payments to be a rebranded version of Stripe that operates as Shopify’s built-in feature.

With Shopify Payments, all of your payments are processed and logged in real-time on the Shopify dashboard. This allows you to easily check them within your Shopify dashboard without needing to log-in at multiple places to check payment data.

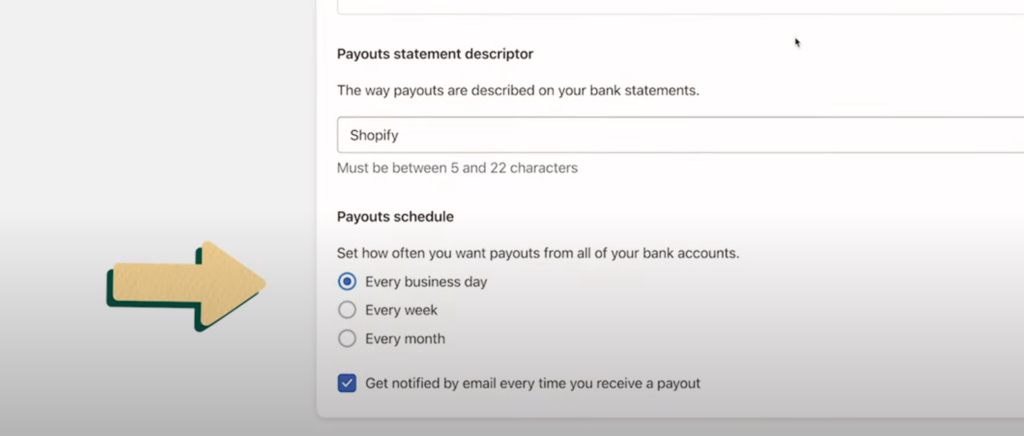

You can get your funds transferred into your bank account within 7 business days after capturing a customer payment. This pay period may vary depending on your store location. Shopify also have an option for merchants to schedule their payouts that helps them get paid at recurring intervals, such as a specific day, every month, or every week.

To view your Shopify payout information, you can:

- Go to your Shopify admin

- Select “Settings”

- Select “Payments”

- Select “View payouts”

That’s all for this section. Now, let’s move forward and understand how much Shopify charges for the transfer of funds.

How Much Does Shopify Payments Charge?

Using Shopify Payments means canceling out a bunch of additional fees that would otherwise be incurred when working with third-party gateways. This is because Shopify Payments does not charge any transaction fees even when you have multiple payment gateways in use.

However, you’ll have to pay for standard credit card processing fees charged by payment processors depending on your chosen Shopify plan.

Here’s the breakdown for transaction charges with Shopify Payments.

| Shopify Pricing Plans | Credit Card Charges | In-person Payment Charges |

| Basic Shopify | 2.9% + $0.30 USD | 2.6% + $0.10 USD |

| Shopify | 2.7% + $0.30 USD | 2.5% + $0.10 USD |

| Advanced Shopify | 2.5% + $0.30 USD | 2.4% + $0.10 USD |

Choosing higher-tier Shopify plans helps you save on incurring transaction charges. This can be your way to save on credit card processing costs when you experience a significant increase in transaction volume. Also, for the Shopify starter plan, you still have to pay 5% of transaction fees, regardless of the payment provider you choose.

That’s everything you need to know about transaction fees and credit card fees with Shopify Payments. But hold on, there are a few other fees to keep in mind. Let’s talk about them.

- Currency Conversion Fee: when a customer places an order in a currency that differs from your store’s base currency, you may need to pay for a currency conversion fee. Shopify charges a small currency conversion fee, typically 1.5% for USD transactions and 2% for non-USD transactions, to cover the processing costs associated with converting currencies.

- Chargebacks: Shopify helps minimize fraudulent activities but in some circumstances, you may still be responsible for chargeback fees. Common chargeback fees for US sellers are $15 but may vary depending on the outcome of the dispute and your Shopify plan.

- Returns and Exchange: Returns and exchange are a normal part of doing business and they may incur additional fees for shipping payment processing. You can avoid these charges by creating a clear return and exchange policy.

- POS fees: Each paid Shopify plan comes with Shopify POS Lite, helping you with order and product management, and the ability to build customer profiles. While scaling you may need to upgrade to Shopify POS Pro which comes with advanced POS features, such as faster workflows, more control over staff permissions, and in-depth inventory reporting tools. This comes with an extra fee of $89 per month per location.

That’s all about the costs associated with Shopify Payments.

Let me also mention that Shopify won’t charge you any additional transaction fees for orders that are processed through Shopify Payments, Shop Pay, Shop Pay Installments, and Paypal Express. Also, you won’t need to pay extra transaction fees on manual payment methods such as cash, cash on delivery (COD), and bank transfers.

Lastly, Shopify Plus merchants, using Shopify Payments as their primary gateway will have their transaction fees waived for all other payment methods used.

Note: I recommend you to visit the Shopify website and Shopify’s documentation to understand the most up-to-date and accurate information regarding fees.

With that in mind, let’s move to understand how Shopify payments differ from other third-party payment gateways.

What Is the Difference Between Shopify Payments and Other Third-party Payment Providers?

In your first review, you may find Shopify payments to be like any other payment processor. Even though it has many similarities, it’s too different.

Let me point out some key differences in a table for your easy understanding.

| Aspects | Shopify Payments | Third-Party Payment Providers | WHO WINS? 👑 |

| Integration with Shopify | It is pre-integrated with Shopify. | It requires an additional setup outside the Shopify environment, which may require tech work. | Shopify Payments 👑 |

| Transaction Fees | Shopify Payments has a single simplified charge (2.9% + $0.30 per transaction, depending on your Shopify plan) that covers both credit card processing and payment processing fees.There are no extra transaction fees charged by Shopify. | Third-party providers also have similar calculations of transaction fees (credit card processing fees + transaction fees).However, when choosing third-party providers to process your Shopify transactions, you’ll need to pay an extra amount to Shopify for each transaction you make, varying depending on your Shopify plan.Here’s the breakdown for the same.Basic Shopify Plan: 2%Shopify Plan: 1%Advanced Shopify Plan: 0.6% These transaction fees cover the cost for Shopify to integrate with external payment providers. | Shopify Payments 👑 |

| Fees Structure | Shopify Payments has a simple, tiered fee structure, based on chosen Shopify plan.There is no charge other than a subscription plan to use Shopify Payments. | Unlike Shopify Payments’ all-inclusive fee, third-party processors offer varied pricing including monthly fees and per-transaction fees with potential volume discounts. | Shopify Payments 👑 |

| User Experience | Shopify Payments is Shopify’s built-in payment processor and offers a seamless checkout experience without being redirected to a separate page. | Most third-party processors offer seamless integrations, but some might redirect customers to a separate page hosted by the processor to complete the payment. | Shopify Payments 👑 |

| Global Reach | Shopify Payments works for limited countries only. | Third-party payment processors often have a wider reach, and support more countries and more currencies. | Third-party Payment Providers 👑 |

| Dispute Resolution | Shopify Payments offers guidance and support throughout the dispute process and help you gather evidence to fight the chargeback. However, the responsibility for resolving the dispute ultimately falls on the merchant. | Third-party payment processors have their own dispute-resolution policies, making it necessary to conduct thorough research before choosing a provider. | Both 👑 |

This table clearly shows the difference between Shopify payments and other third-party providers.

You can also figure out that Shopify Payments is a better option over any other third-party payment method that you choose, helping you manage your transactions within the Shopify dashboard and save a huge chunk of transaction fees.

Now, that we have discussed almost all the necessary details on Shopify payments, let’s make a big comparison of Pros and Cons.

Pros and Cons of Shopify Payments

Here I’ve listed some benefits and drawbacks of working with Shopify Payments.

Pros of Shopify Payments:

- There is no additional cost for using Shopify Payments in your Shopify store, it’s free

- It’s pre-integrated and is easy to activate

- No additional transaction fees are charged

- It’s designed for Shopify and by Shopify to work seamlessly

- It uses CVV and AVS fraud filters to protect your store against fraudulent payments

- Real-time payment tracking option with a centralized dashboard

- Your buyers will have plenty of payment options

- Support during disputes

- It comes with Shop Pay (BNPL solution)

Cons of Shopify Payments:

- It can be used in limited countries only

- Your business must comply with their Terms and Conditions

As you can see, there are multiple benefits you can avail of when adopting Shopify Payments as your payment method, and the cons are comparatively fewer.

Now, let’s check if Shopify Payments can be a perfect choice for your online store or not.

Is Shopify Payments Right for You?

When choosing a payment service provider, any Shopify store owner focuses on saving transaction fees and not wasting much time in understanding the technicality.

Shopify Payments works on that. It is an easy payment processor to integrate into your Shopify store, allowing you to accept all major payment methods, sell in multiple currencies, and help translate your store into multiple languages.

Using Shopify Payments is the most logical way to spend lesser of transaction fees and enjoy that extra amount of conversion. Also, Shopify does not ask for any fees other than subscription plan fees to use Shopify payments. This helps you save on monthly fees that you would otherwise have to pay to integrate third-party payment providers.

Lastly, you have all your necessary payment data under the Shopify dashboard to simplify your business operations, making Shopify Payments a perfect choice for your online store.

Let’s move to another section where we learn how you can start your journey with Shopify Payments.

How to Get Started with Shopify Payments?

So, finally, it’s time for me to introduce you to a step-by-step process that helps you activate Shopify Payments on your online store. Let’s get ahead.

Step 1: Open your Shopify admin panel.

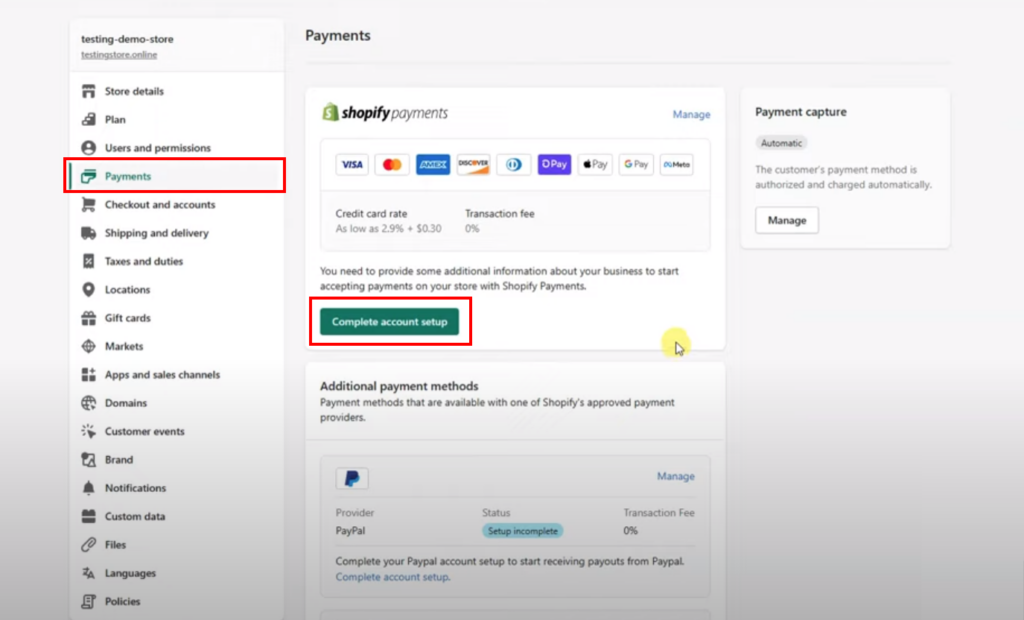

Step 2: Go to the “Payment” section inside the settings. If Shopify Payments is available in your region, you’ll see it listed at the top, followed by additional payment methods to choose from.

If you see it there, select a “Complete Account Setup” option that helps you activate Shopify Payments for your online store to move further in the process.

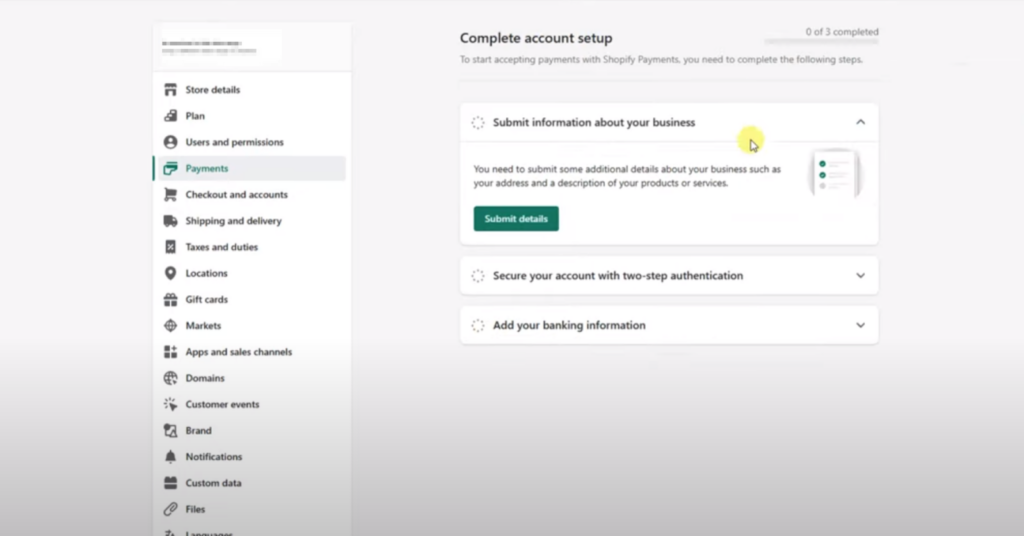

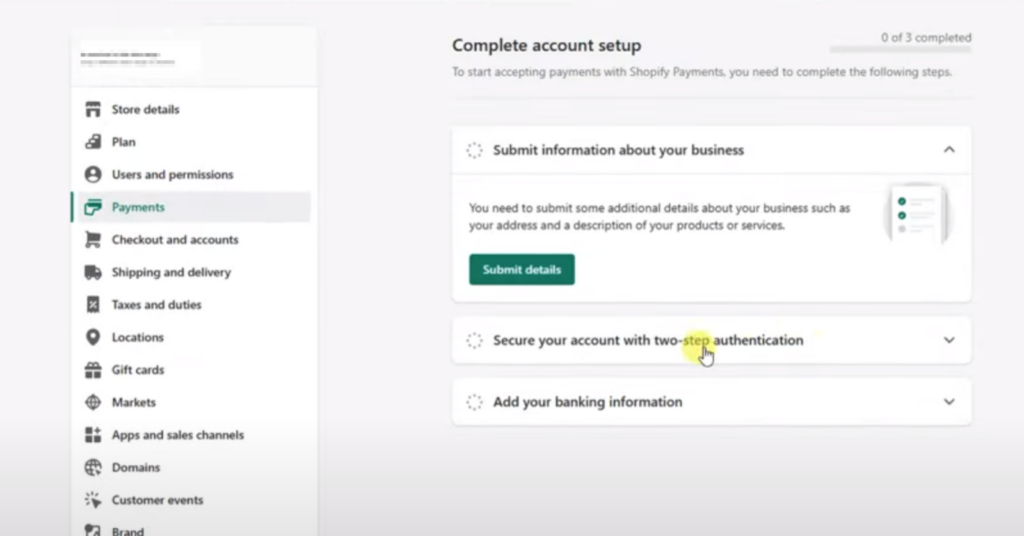

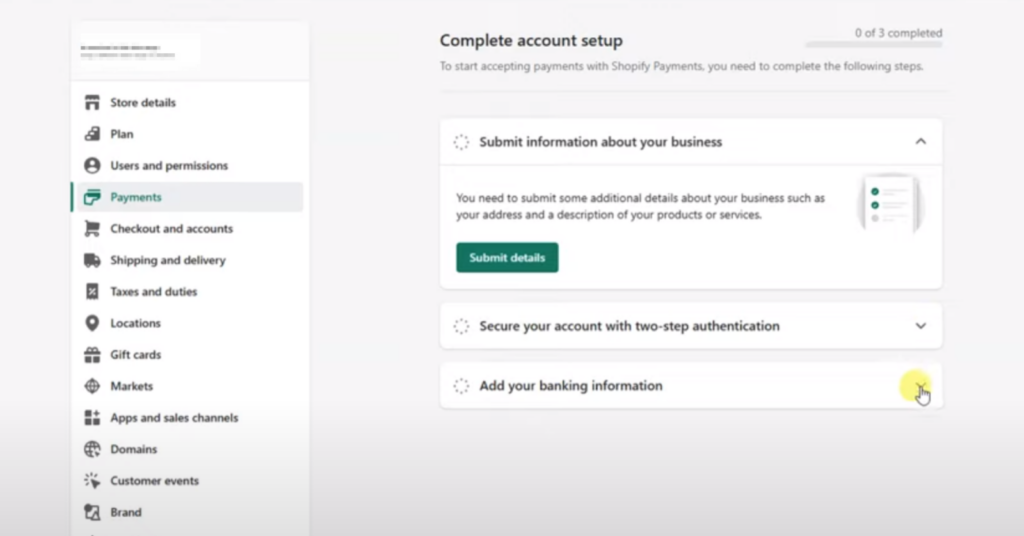

Step 3: Once you proceed with complete account setup process, you’ll see a 3 step process. First step requires you to submit your business information. Click on “Submit Details” to move ahead.

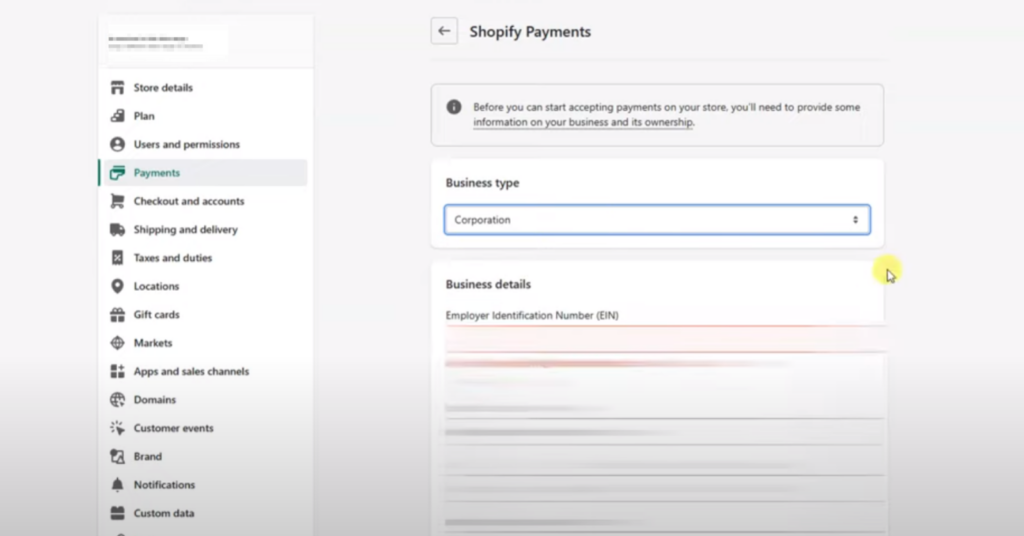

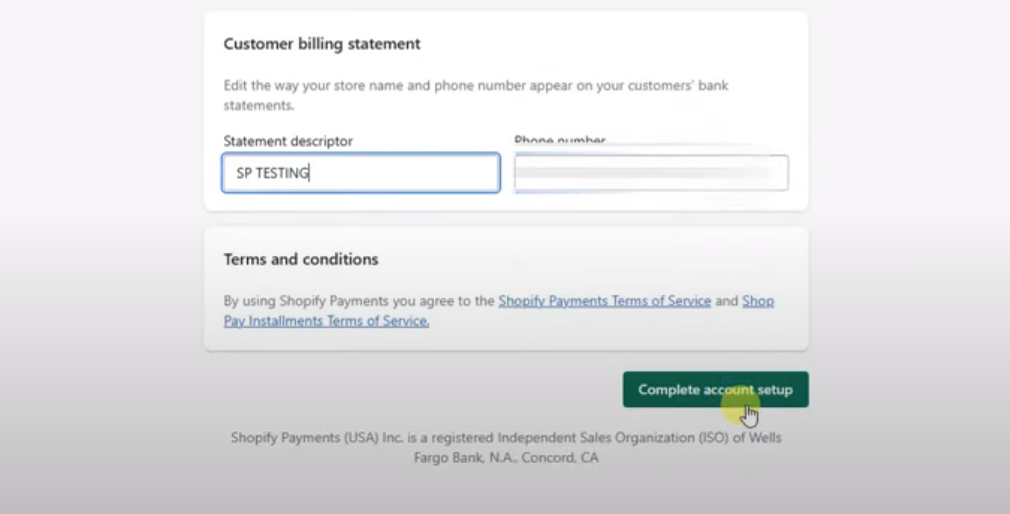

Step 4: First it will ask you to choose your business type, and later, you’ll have to fill in information in various fields, including federal EIN number, business address, personal details, job details, additional owner information, product details, and information that will appear on customer billing statement (such as statement descriptor and business phone number).

Step 5: Once you successfully add information in all the necessary fields, click on “Complete Account Setup”. It will take you to step two.

Step 6: The second step is where you’re asked to turn on the two-factor authentication, which is just to keep your account secure.

Step 7: Lastly, in the third step they’ll ask you to add your banking information so that Shopify and Stripe can deposit your sales amount into your bank account.

And that’s all you need to do to set up Shopify Payments on your store.

Now, let’s move to another section that solves your remaining doubts on Shopify Payments.

FAQs: Shopify Payments

Until now, we understood all the necessary areas that help us decide if using Shopify Payments is a worthy payment processor for your online store or not. You might still have some doubts about certain areas, so, here we’ll discuss them. Let’s start.

1. Is Shopify Payments Safe To Use?

Yes, Absolutely. Shopify Payments is one of the most safe and secure payment processors to handle your online store transactions. It is PCI compliant, ensures a secure network, protects cardholder data, maintains a vulnerability management program, has strong access to control measures, regularly monitors and tests networks, and maintains an information security policy.

Furthermore, one of the core features of Shopify Payments is fraud analysis, which automatically detects and flags potentially problematic orders.

2. What Is The Shopify Payments Fee?

Shopify Payments has a single, simplified per-transaction fee of 2.4% to 2.9% that combines both credit card processing and payment gateway fees. This fee depends on your chosen Shopify plan.

3. What Is The Shopify Payments Processing Time?

After checkout, when the customer pays for an order using Shopify Payments, the amount will reflect in the merchant account within three days of receipt when the payment is processed. This amount can be transferred to your bank account anytime with an easy process.

For new merchants, Shopify Payments may hold your payment for around 14 days as new merchants don’t have the best reputation among customers yet.

4. Do Manual Payment Methods incur fees with Shopify Payments?

No, Shopify Payments does not charge additional transaction fees on manual payment methods such as Cash, Cash on Delivery (COD), or Bank Transactions. This is because these transactions don’t involve credit card processing.

5. Can I Have Another Payment Getaway Along With Shopify Payments?

Yes, you can integrate another payment gateway to work alongside Shopify Payments. But it’s necessary to consider that even if Shopify Payments is activated, all the third-party and alternate payment gateways will incur additional transaction fees by Shopify.

However, if you’re looking to use PayPal and manual payments, there won’t be any additional transaction fees when using Shopify Payments.

6. Is Shopify Payments Better Than Third-party Payment Providers?

Yes, Shopify Payments is a good option to consider if you’re already using Shopify. With Shopify Payments, you’ll only have to pay for credit card processing fees, as there are no monthly fees other than the Shopify subscription plan. However, integrating third-party payment providers comes with separate monthly fees and per-transaction fees.

On top of that, Shopify charges additional per-transaction fees when you choose third-party providers over Shopify payments.

7. What are the Best Payment Solution for Shopify?

Here I’ve listed some of the best payment methods for Shopify store.

Best Payment Solutions:

- Shopify Payments

- PayPal Payments

- Google Pay

- Stripe

- Apple Pay

- Amazon Pay

- Authorize.new

8. Does Shopify Payments Use Stripe?

Yes, Shopify uses Stripe to power its payment solution, Shopify Payments. Due to this integration, you will no longer see the Stripe gateway as an option in your Shopify account. However, in some parts of the world where Shopify Payments hasn’t yet been introduced, you might still have access to the original Stripe gateway.

9. Can I Use PayPal with Shopify Payments?

Yes, you can use PayPal when using Shopify Payments and you won’t be charged for additonal transaction fees with PayPal. However, If you’re not using Shopify Payments and you choose PayPal instead, Shopify will charge an additional fee, known as a third-party payment processing fee.

10. Does Shopify Payments Hold Your Money?

Yes, Shopify Payments will hold your money for up to 3 business days to review banking documentation or information for your business, as the details of the person creating the account do not always match perfectly. So, your transaction money can be on hold until your details are verified by Shopify’s banking partners.

11. Is It Worth Using Shopify Payments To Avoid Extra Fees?

Typically, yes, because Shopify Payments offers the advantage of a pre-integrated payment processing solution with no additional transaction fees and easy management of store funds. But ultimately, it depends on your store’s specific needs and requirements.

Now that you know Shopify Payments this well, it’s time to get started.

Our team of exceptional Shopify Experts can help you seamlessly integrate Shopify Payments to your online store and also help with your further Shopify requirements.

Final Thoughts

Finding the best of anything involves, trial and error. And Shopify Payments is definitely the best payment processor for Shopify. I hope this article answers all your questions regarding Shopify Payments. In case of any queries, you can leave a comment below or contact us today. We are happy to help.

Lastly, if you’re new to Shopify and preparing your store for a successful launch, our Shopify Setup Checklist will help you do it right.

Post a Comment

Got a question? Have a feedback? Please feel free to leave your ideas, opinions, and questions in the comments section of our post! ❤️