11 Best Payment Gateways in India (2026)

The surge in online transactions in India and customers’ demands to get more secure and versatile payment options is never-ending! It keeps fueling fintech companies to introduce innovative payment solutions for merchants and customers to choose the best payment gateways in India for their needs.

No wonder how the Indian payment gateway market size may reach $2.66 billion by 2029. But, the question looms over every merchant — what payment gateway provider should you choose in India?

We’ve made the process quite simpler for you! Our filtered list of the best payment gateways in India will make your hunt quick and easy.

Top 11 Payment Gateways in India

- Paytm

- Instamojo

- PayU

- Razorpay

- Stripe

- CCAvenue

- Zaakpay

- PayKun

- Cashfree

- PayGlocal

- HDFC SmartGateway

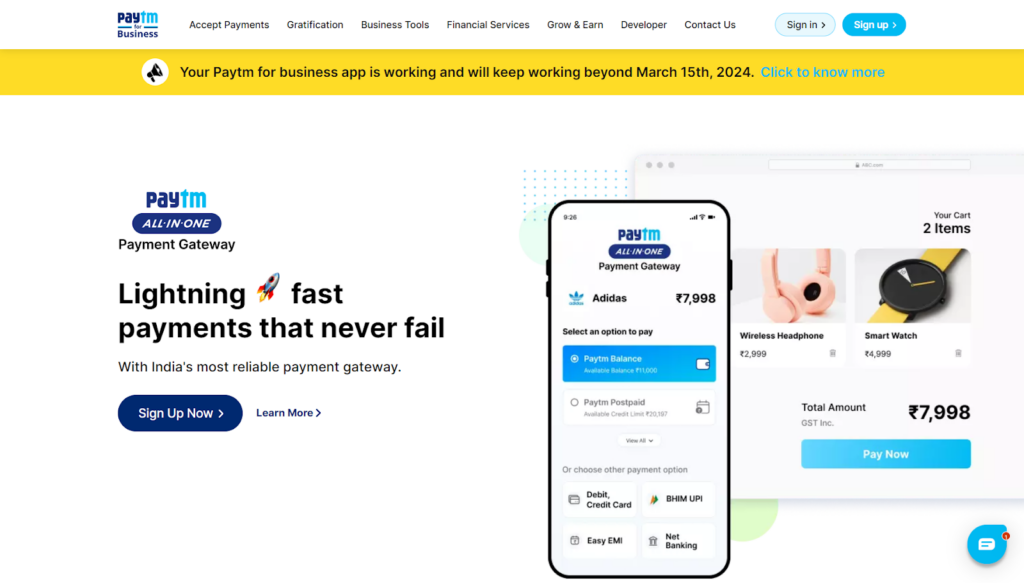

1. Paytm

Paytm is an all-in-one payment gateway solution for Indian businesses. It claims a 100% payment success rate and has gained the trust of 300 million Indians. If you’re looking for lightning-fast payments and a robust banking infrastructure for your business, Paytm is the right choice for you.

Paytm also allows advertising via ads and gift vouchers. You can even enable subscription-based payments via Paytm.

Features

| Payment Methods | Debit/Credit cards, Net banking, UPI, Paytm Bank Wallet, Paytm Postpaid, No-cost EMIs, etc. (100+ methods) |

| Registration Documents | Check here. |

| Settlement Period | T+1 |

| Mobile App Integration | All-in-one SDK |

| Onboarding Time | 30-minute onboarding process (instant activation) |

| Customer Support | Phone and email |

| eCommerce Platforms Supported | 30+ platforms including Magento, OpenCart, WordPress, PrestaShop, etc. |

| Other Integrations | Shopify, Wix, Zoho, Urban Piper, Limetray, Kare4U, Shopaccino, GlobalLinker, Shopmatic, Zepo, etc. |

| Dashboard | Real-time analytics and customisable reports |

| Clients | Flipkart, Zomato, Uber, Swiggy, Myntra, Airtel, etc. |

Fees

A. Online Payments (+18% GST)

- For startups, small & medium businesses

- UPI: 0%

- Paytm Bank Wallet: 1.99%

- Paytm Postpaid: 1.99%

- Debit Cards: 0% – 0.9%

- Credit Cards: 1.99%

- Other Cards: 2.99%

- Netbanking: 1.99%

- EMI: 2.99%

- For enterprises – Custom Quote

B. In-Store Payments (+18% GST)

- Small Merchant: Up to 3.99%

- Big Merchant: Up to 3.99%

Check Paytm’s pricing page for more details.

Pros

- 99.99% uptime

- 100% online onboarding with Instant activation

- Receive payments within 30 minutes of integration

- Can handle 10000+ transactions/second

- Automatic updates

- Advanced 2-click UPI flow

- Zero annual, setup, and withdrawal fees

Cons

- Concerns for security

- Verification requires visiting the physical office

- Can’t access Paytm Payment Bank account online

2. Instamojo

Instamojo is the choice of 20,00,000+ Indian businesses with its high-speed and optimized checkout experience for customers. You can choose between two checkout options — either a custom page on your website or a pay button on any of your web pages.

The best part — Instamojo’s convenience fee allows you to pass on your transaction fee to customers. It means you get the payment gateway for free.

Features

| Payment Methods | 100+ options including Google Pay, Netbanking, and debit/credit cards, Pay Later, EMIs, wallets, UPI, etc. |

| Registration Documents | Check here. |

| Settlement Period | T + 3 |

| Mobile App Integration | Ionic SDK, Android, iOS |

| Onboarding Time | Instant onboarding via email signup |

| Customer Support | Email and Help Center |

| eCommerce Platforms Supported | Drupal ,WordPress, PrestaShop, CS Cart, WHMCS, Magento, Magento 2.0, Meteor JS, WooCommerce, and OpenCart |

| Other Integrations | Payment APIs, Libraries, Webhooks, Custom Apps |

| Security | PCI-DSS |

| Dashboard | Single dashboard for all insights |

| Clients | The Wire, Swimming Academy, InsightsIAS, Saffron Stays, etc. |

Fees

- Online Store (+ GST)

- Lite: ₹0/year

- Starter: ₹3999/year

- Growth: ₹9999/year

- Do-it-for-me: Custom Quote

- Smart Page (+ GST)

- Basic: ₹0/year

- Pro: ₹9999/year

- Payment Link

- Quick: ₹0/year

- Smart: ₹2999/year

Pros

- 14-day money-back guarantee

- Can build a custom landing page for your business

- Zero withdrawal or setup fees

- Easy integration with payment APIs and plugins

- Safe refunds to customers

- Responsive developer support for all integrations

- Add multiple beneficiaries or split payments

- Choose the API of your choice for integration

Cons

- Customers might have to pay convenience fee (transaction fee for businesses)

- Charges an annual fee

- faster payouts at an additional fee

3. PayU

PayU is ruling over the trust of more than 5 lakh businesses because of its focus on building better payment experiences — for both businesses and customers. It claims to have industry-best payment success rates and offers two checkout options for your business — a payment gateway on your website and app-based checkout.

PayU has its own API playground, a real-time testing environment for businesses to test their payment APIs with product integration.

Features

| Payment Methods | 150+ payment methods including credit/debit cards, netbanking, BNPL, UPI, EMIs, and wallets |

| Registration Documents | Check here. |

| Settlement Period | T + 2 |

| Mobile App Integration | Super-light SDKs and APIs for plug-and-play functionalities, iOS, Android, and React Native |

| Onboarding Time | 1- days |

| Customer Support | Live chat, tickets, email |

| eCommerce Platforms Supported | Magento, WordPress, BigCommerce, WooCommerce, etc. |

| Other Integrations | Wix, Shopify, Shopmatic, Zoho, and more |

| Security | PCI-DSS |

| Dashboard | Merchant Dashboard to setup and manage payment options |

| Clients | Netflix, Airbnb, Goibibo.com, Book My Show, etc. |

Fees

- Visa, Mastercard, Net Banking, BNPL, Wallets (domestic transactions): 2% + 18% GST

- Diners, American Express, EMI: 3% + 18% GST

- Large Enterprises: Custom Quote

For more details, check out PayU’s pricing page here.

Pros

- 100% online onboarding

- Widest set of payment options available

- Affordable solution

- Offers multilingual checkout experience

- One-click payment experience for customers

- 5-minute refund reimbursement

- No setup and maintenance charges

- Ready-to-use API documentation and designs for developers

Cons

- Priority settlements might come at a fee

- Customer support always seems to be busy.

4. Razorpay

Razorpay offers a comprehensive product suite to its customers for full-fledged payment management. It offers best-in-class performance and easy-to-integrate checkout pages. Its integrations are quick to set up — taking around 30 minutes at most — which makes it a popular choice among small businesses.

Razorpay has more than 4 million cards stored, preventing customers from entering card details every time.

Features

| Payment Methods | Credit/Debit cards, EMIs, PayLater, Netbanking, UPI, and wallets |

| Registration Documents | Check here. |

| Settlement Period | T + 2 |

| Mobile App Integration | Android and iOS SDKs |

| Onboarding Time | 3-4 days |

| Customer Support | Live chat, phone, email, tickets |

| eCommerce Platforms Supported | Wix, WooCommerce, Magento, CS Cart, PrestaShop, WordPress, BigCommerce, Drupal Commerce, etc. |

| Other Integrations | JS, Ionic, React Native, Flutter, Capacitor, Shopify, etc. |

| Security | PCI-DSS Level 1 |

| Dashboard | Detailed insights on refunds, payments, settlements, and much more. |

| Clients | Zoho, Zomato, Aditya Birla Capital, Airtel, Book My Show, etc. |

Fees

- Standard Plan

- Platform Fee: 2% + GST

- Diners, Amex cards, EMI, Corporate Credit Cards: 3%

- Enterprise Plan: Custom Quote

Pros

- Completely online onboarding

- Easiest integration

- Developer-friendly APIs and plugins

- Offers no-cost EMIs

- Allows creating custom-branded payment pages

- Doesn’t charge setup or annual maintenance fee

- Dedicated internal security team ensuring data safety

- Personalized payment experience for every user

- Accept and refund payments with one click

Cons

- Doesn’t have SSL support

- Transaction fees are a bit expensive

- Customer support is poor

5. Stripe

Stripe is a unified payment gateway, popular among startups and enterprises alike. Its one-click checkout and built-in customization options offer a seamless experience to both businesses and customers. It uses ML-based optimizations to reduce fraud. Apart from payment links and forms, it also allows you to accept card payments outside of Stripe with its flexible UI components.

With Stripe, you can manage your payments across multiple channels — both online and in-person.

Features

| Payment Methods | 100+ options including Credit/debit cards, UPI, BNPL, bank transfers, wallets, cash-based vouchers, etc. |

| Registration Documents | Check here. |

| Settlement Period | 7 days |

| Mobile App Integration | APIs and SDKs for Android and iOS |

| Onboarding Time | Few minutes to hours based on review process |

| Customer Support | Discord, phone, chat, email, documentation, and knowledge-base |

| eCommerce Platforms Supported | Shopify, WooCommerce, Magento, prestashop, OpenCart, etc. |

| Other Integrations | Flutter, .Net, Codeva, Python, etc. |

| Security | PCI DSS Level 1, PSD2 and SCA Compliant, SSAE18/SOC and SSAE18/SOC 2 type 1 and type 2 reports |

| Dashboard | Powerful dashboarding capabilities |

| Clients | Amazon, Airbnb, Zoom, Figma, Shopify, etc. |

Fees

- Credit/debit cards: 2%

- Disputed payments: ₹1000/lost dispute

- Recurring payments: 0.5% – 0.8%

- Invoicing: 0.4%/paid invoice

Check out Stripe’s pricing page for more details.

Pros

- Frictionless customer experience

- Pre-build payment UIs to ease developers’ work

- Offers flexible UI components to customize the checkout experience

- No-code payments link — can be turned into QR codes or buy buttons

- Can A/B test payment methods

- Doesn’t charge any annual maintenance fee

- Extensive documentation for developers

- Launch payment methods faster with single integration

- Existing customers can use previously saved payment information

Cons

- Challenging to use for non-tech people

- A bit expensive

6. CCAvenue

CCAvenue is an advanced and omnichannel payment gateway solution for managing payments on the go. It is also the first in India to offer Central Bank Digital Currency for e-retailing payments. The platform claims 96.50% payment success rate to activate your account within minutes. It also allows accepting contactless payments via its POS terminal on smartphones.

The best part — CCAvenue offers a free storefront for businesses with no website.

Features

| Payment Methods | 200+ payment methods including Credit/Debit cards, netbanking, prepaid instruments, EMIs |

| Registration Documents | Check here. |

| Settlement Period | T +2 or T+3 |

| Mobile App Integration | SDKs for iOS, Android, and Windows |

| Onboarding Time | 1 hour |

| Customer Support | Email, chat, and phone |

| eCommerce Platforms Supported | Magento, OpenCart, WordPress, PrestaShop, Joomla, etc. |

| Other Integrations | Moodle, Buildabazaar, Interspire, WHMCS, etc. |

| Security | PCI DSS V3.2.1, iFrame |

| Dashboard | Smart analytics and real-time statistical reports |

| Clients | Make My Trip, Lakme India, Baggit, Bombay Dyeing, Myntra, etc. |

Fees

- Startup Pro (No Setup Fee)

- Platform fee: 2.00%

- Corporate / Commercial Credit Cards (Domestic): 3.00%

- American Express / Amex EMI & Diners Club: 4.00%

- Annual Software Upgradation Charges: ₹1200

- Startup Privilege (Setup Fee)

- Setup Fee: ₹30,000

- Other Fees: Custom Quote

Pros

- Multilingual checkout page

- Deliver a localized shopping experience to customers

- Customize your payments page to suit your branding needs

- Smart retry system for failed transactions

- Automatically switches between bank gateways to ensure high success rate

- 100% digital KYC

- Fast and frictionless buying experiences for customers

- Save card details of your customers securely

- Free and customized storefront for merchants with no website

Cons

- Charges annual maintenance fees

- Settles weekly payments only above Rs. 1000

- Customer support is poor

7. Zaakpay

Zaakpay (by MobiKwik) is an all-in-one payment gateway solution for businesses to streamline payment processing. It claims a high payment success rate and offers an instant checkout experience to customers. If you don’t have any website or app, Zaakpay is just what you need. It offers three checkout options — Express, Custom UI, and Seamless.

Zaakpay’s instant installation, onboarding, and settlements attract businesses across industries.

Features

| Payment Methods | 100+ options including UPI, QR codes, Debit/Credit cards, Netbanking, Wallets, and BNPL |

| Registration Documents | Check here. |

| Settlement Period | 24*7 settlements as per banks |

| Mobile App Integration | SDK for Android |

| Onboarding Time | Same-day onboarding |

| Customer Support | Phone and email |

| eCommerce Platforms Supported | Magento, PrestShop, OpenCart, WooCommerce |

| Other Integrations | PHP, Python, JAVA, JSP, Node JS, Flutter, etc. |

| Security | PCI DSS Compliant |

| Dashboard | Robust dashboard for payment management |

| Clients | Bajaj Finserv, Indiamart, 1mg, Jockey, Uber, etc. |

Fees

- Standard Plan (+GST)

- UPI and Rupay Debit Card: 0%/transaction + platform charges

- VISA, Maestro, Mastercard, MobiKwik Wallet, 50+Banks, and Rupay Credit Card: 1.9%/transaction

- American Express and Diners: 2.9%/transaction

- ICICI Pay Later and Ola Postpaid: 2.25%/transaction

- Enterprise Plan (+GST): Custom Quote

Pros

- Instant checkout experience

- One-click payments without website or app

- API-powered solution designed for developers

- Flexible integration options

- Custom checkout page to match your branding

- Guarantees a 99.9% uptime

- No-code integrations for faster payment processing

- Get instant settlements across different banks for your cash flow needs

Cons

- Poor customer support

- Doesn’t have recurring billing option

8. PayKun

PayKun is a digital payment gateway solution that aims to amplify your customers’ checkout experience. It offers a test mode to experience its features before making a decision. The payment gateway has 15000+ merchants actively using the platform. You can either integrate a plugin on your website, share a payment link, or embed a button to accept payments.

PayKun charges lowest transaction rates in the industry and offers fast and regular settlements.

Features

| Payment Methods | 120+ payment options — Credit/Debit cards, Netbanking, Wallets, UPI, QR Code, and EMI |

| Registration Documents | Check here. |

| Settlement Period | T+1 to T+3 |

| Mobile App Integration | SDKs for Android and iOS |

| Onboarding Time | 1 or 2 days |

| Customer Support | Call, live chat, email, Whatsapp with dedicated manager |

| eCommerce Platforms Supported | OpenCart, PrestaShop, WordPress, WooCommerce, Magento |

| Other Integrations | PHP, Python, .Net, Js Checkout, WHMCS |

| Security | PCI DSS Compliant |

| Dashboard | Intuitive and powerful dashboard |

| Clients | Giggles Infotech, Tinnka, SparrowHost, AirGun Bazaar, etc. |

Fees

- UPI, Debit Cards, Netbanking, Wallets : 1.75%

- Paytm Wallet: 2.00%

- Credit Cards: 2.00%

GST is applicable on all the options.

Pros

- No set-up and maintenance charges

- Extensive documentation for merchants and developers

- Fast and regular payouts

- Free integration assistance

- Developer-friendly integrations

- Autofill OTP options for easier mobile payments

- Customize your checkout page to suit your branding

- Has the best customer support

- Charges lowest TDR

Cons

- Awareness is much less

- Claims lowest TDR, however, reviews suggest otherwise

9. Cashfree

Cashfree holds the trust of more than 6,00,000 businesses with its growth-focused payment gateway for mobile apps and websites. It is popular for speedy settlements (within 15 minutes) and refunds — a win-win for both merchants and customers. The platform claims 15% higher payment success rates with its 3-time auto-retry feature.

Cashfree provides 4 UPI options — mobile apps, desktop QR, WhatsApp links, and collect requests.

Features

| Payment Methods | 120+ options including Credit/Debit cards, UPI, Netbanking, Wallets, BNPL, and EMIs |

| Registration Documents | Check here. |

| Settlement Period | Within 15 minutes of payment capture |

| Mobile App Integration | SDKs for Android, iOS, Flutter, React Native, Cordova, etc. |

| Onboarding Time | Same-day onboarding |

| Customer Support | Email, knowledge base, support tickets |

| eCommerce Platforms Supported | Shopify, WooCommerce, Magento, PrestaShop, WordPress, Wix, etc. |

| Other Integrations | RESTful APIs, Javascript SDK, PHP, Python, etc. |

| Security | PCI-DSS Level 1 |

| Dashboard | Centralized control over insights |

| Clients | ixigo, DG Pay, Nykaa, Tata CliQ, Meesho, etc. |

Fees

- Platform fee: 1.95%

- UPI on Credit Cards: 2.15%/transaction

- Credit Card EMI: TDR + 0.25%/transaction

- Debit Card EMI: 1.50%/transaction

- Cardless EMI: 1.90%/transaction

- Pay Later: 2.20%/transaction

Pros

- Designed specifically for Indian merchants and customers

- Get settlements even on a bank holiday

- No setup and maintenance charges

- Fastest settlements in the industry

- No-code Offer Engine to configure special discounts

- Widest range of BNPL options available

- Can process 3000 transactions per second

- RBI complaint token vault to save card details

- Auto-retry feature available

- Auto reconciliation for time-sensitive transactions

Cons

- Customer support is delayed and has no call option

- Pricing is a bit expensive

10. OPEN

OPEN is Asia’s well-known and secure payment gateway that uses connected banking to manage business transactions. With instant settlement, improved reliability, and smooth integration capabilities, OPEN is an affordable choice for 3.5 million+ merchants. It is also a popular choice among tax practitioners and banks.

You can pay, manage, and reconcile your bills in one place — OPEN offers a smart platform to handle your accounts.

Features

| Payment Methods | 200+ options — Credit/Debit cards, IMPS, RTGS, NEFT, UPI, Netbanking, Wallets, etc. |

| Registration Documents | Check here. |

| Settlement Period | Immediate settlement for UPI payments, for others — T+2 |

| Mobile App Integration | SDKs for iOS and Android |

| Onboarding Time | Immediate onboarding |

| Customer Support | Email, phone, support tickets, knowledge base |

| eCommerce Platforms Supported | PrestaShop, Magento, WooCommerce, OpenCart, etc. |

| Other Integrations | Tally, Zoho, Oracle, NetSuite, Microsoft Dynamics |

| Security | PCI DSS, ISO 27001 Certified, AICPA SOC |

| Dashboard | Central view of payments, refunds, and other insights |

| Clients | Flybig, Aisle, InShorts, Box8, Kidzon, etc. |

Fees

- 0-10 lakhs: ₹1,250/Month + GST + 1.95%/transaction for payment links

- 10-25 lakhs: ₹2,500/Month + GST + 1.9%/transaction for payment links

- 25-50 lakhs: ₹4,000/Month + GST + 1.85%/transaction for payment links

- 50 lakhs+: Custom Quote + GST + 1.8%/transaction for payment links

Check OPEN’s pricing page for more details.

Pros

- Simplifies finances and cash flow management

- Connected banking to track all payments in one place

- Allows creating and importing bills/invoices

- Automated reconciliation of payments

- Get a bird’s eye view of your accounts

- Supports split payments

- Can opt for instant settlement, directly in your bank account

- Offers a 7-day free trial with all the features

Cons

- Charges annual fee

11. HDFC SmartGateway

Lastly comes one of the most reliable payment options for businesses of all sizes in India — HDFC SmartGateway! Backed by a large Indian commercial bank (HDFC Bank), this payment solution is PCI DSS compliant and uses industry-standard security measures to protect your customers’ financial information.

With the HDFC payment gateway, you can receive your funds immediately after a customer makes a purchase. This can improve your cash flow and help you to manage your finances more effectively. HDFC’s variety of payment options, competitive pricing, and support for international payments make it a strong contender for the title of best payment gateway in India.

Features

| Payment Methods | 150+ options — Credit/Debit cards, wallets, net banking, UPI, and QR-based payments, etc. |

| Registration Documents | Check here. |

| Settlement Period | Immediate settlement into the business account |

| Mobile App Integration | SDKs for iOS and Android |

| Onboarding Time | Immediate onboarding |

| Customer Support | Email, phone, support tickets, knowledge base |

| eCommerce Platforms Supported | WooCommerce |

| Security | PCI DSS |

| Dashboard | Central view of payments, refunds, and other insights |

Fees

- Below <₹1,00,000 per month: ₹999 per month

- Between₹ 1,00,000 – ₹5,00,000: ₹499 per month

- Between ₹5,00,000 – ₹25,00,000: ₹100 per month

- International & Commercial card transactions: 2.75%

Check out HDFC Charges for more details.

Pros

- Instant settlement

- 100% chargeback facility

- Accepts payment in 15 international currencies

- Backed by a large bank in India

- HDFC offers fraud prevention tools

- HDFC supports recurring billing – helpful for businesses that sell subscriptions

Cons

- Don’t support popular eCommerce platforms like Shopify, Magento

Note: If you really want to use the ‘HDFC SmartGateway’ but are unable to find the plugin or connector for your specific eCommerce platform, you can inquire here! We can build a custom solution for you. 💜

Time to make a choice!

Think about what your customers seek the most when directed to the checkout page. Do they wonder if their preferred payment method is allowed? Are they worried about platform maintenance charges? Do they leave the checkout page after one failed transaction?

The answer to these questions can help you make an informed choice — maybe pick two or three gateways that tick all the boxes!

More resources:

Post a Comment

Got a question? Have a feedback? Please feel free to leave your ideas, opinions, and questions in the comments section of our post! ❤️